Although 2023 was a down year for global M&A volumes, the same cannot be said for Euclid Transactional’s global claims team, which helped facilitate over $225 million of payments by our carriers to help make clients whole for breaches of representations and warranties in acquisition agreements. The team continued to build on its reputation for delivering a consistent, efficient and proactive claims handling process to our clients, who have now received payments of nearly $700 million since our founding in 2016.

Headline claims figures

- The team resolved 28 claims in 2023 resulting in payments totaling over USD 227 million (which is nearly a 62% increase from 2022).

- Since we started underwriting in late 2016, Insureds have received payments of more than USD 684M in indemnified loss under policies issued by Euclid.

- We received 255 claim notices globally in 2023, which is an increase of about 15% from 2022.

Euclid’s First Claims Study

This year, Euclid published its first claims study based on our experience of handling over 1,000 claims received since 2016 as of June 30, 2023 (which can be accessed here). We look forward to releasing our claims study annually and welcome feedback about what we should discuss next year.

Our experience in 2023

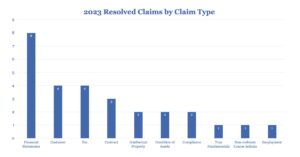

As shown in the graph below, in 2023 we paid a wide variety of claims, including in relation to breaches of representations regarding customers of acquired companies, tax, and intellectual property-related issues.

While inaccurate financial statements continue to be a common basis for claims, accounting for 8 of our 28 paid claims in 2023, we have seen an increase in the number of customer and tax claims, each representing 4 of our claims paid.

This year, we saw another increase in claim notices as a result of the record-number of policies underwritten in the second half of 2020 and throughout 2021 and 2022, but we believe the uptick has not impacted the efficiency or commercial nature of Euclid’s claims handling process.

One of the largest claims we paid in 2023 was also one of our fastest-moving. The client asserted Loss of the entire transaction value as a result of fraudulent statements made about customers. Euclid’s claims team, working quickly and collaboratively with the client and broker, resolved the claim for the full policy limit within four months. While this kind of result may not be possible under all circumstances, it demonstrates one of the benefits of buying a transactional risk policy from Euclid’s highly trained and dedicated team. With the largest dedicated claims team in the transactional insurance industry, Euclid has over 20 full-time professionals located in North America and Europe. In 2023, Euclid added fully dedicated claims handlers to the team in Toronto and London. With these additions, we became the first to have a fully dedicated transactional insurance claims handler in Canada.

As we look ahead to 2024, we are excited to continue to partner with our excellent clients and brokers as we continue to expand and develop the transactional insurance market together.