Euclid Transactional’s claims team delivered a strong finish to 2024 for our clients, settling five claims in December and bringing the total amount paid since our program began 8 years ago to just under $995 million. As we look toward 2025 and surpassing $1 billion paid, we wanted to share some of our 2024 highlights and some of the reasons we feel we consistently provide the level of service our clients expect.

Headline claims figures

- The team resolved 47 claims in 2024 resulting in payments totaling over $306.6 million. These numbers are up significantly from 27 claims resolved and $220.5 million in payments in 2023.

- Since we started underwriting in late 2016, our insureds have received payments of more than $994.9 million in indemnified loss under policies issued by Euclid.

- We received 307 claim notices globally in 2024, which is an increase of about 9% from 2023.

Our experience in 2024

The increase in claims payments in 2024 was anticipated, given that the number of policies we underwrote in 2021 almost doubled from 2020 and stayed much higher than 2020 levels even as the M&A market shrank in 2023. We anticipated this trend, and we feel our 20+ person claims team was able to maintain its efficiency and commerciality despite the high volume of 2024. As just one example of our efficiency, our claims team was able to settle a financial statements claim in just 26 days after receiving the insureds’ Loss report asserting multiplied damages. While not every claim may resolve within such a short time period, the success in bringing this claim to resolution shows the efficiency with which an RWI claims team staffed to handle claims at scale can operate.

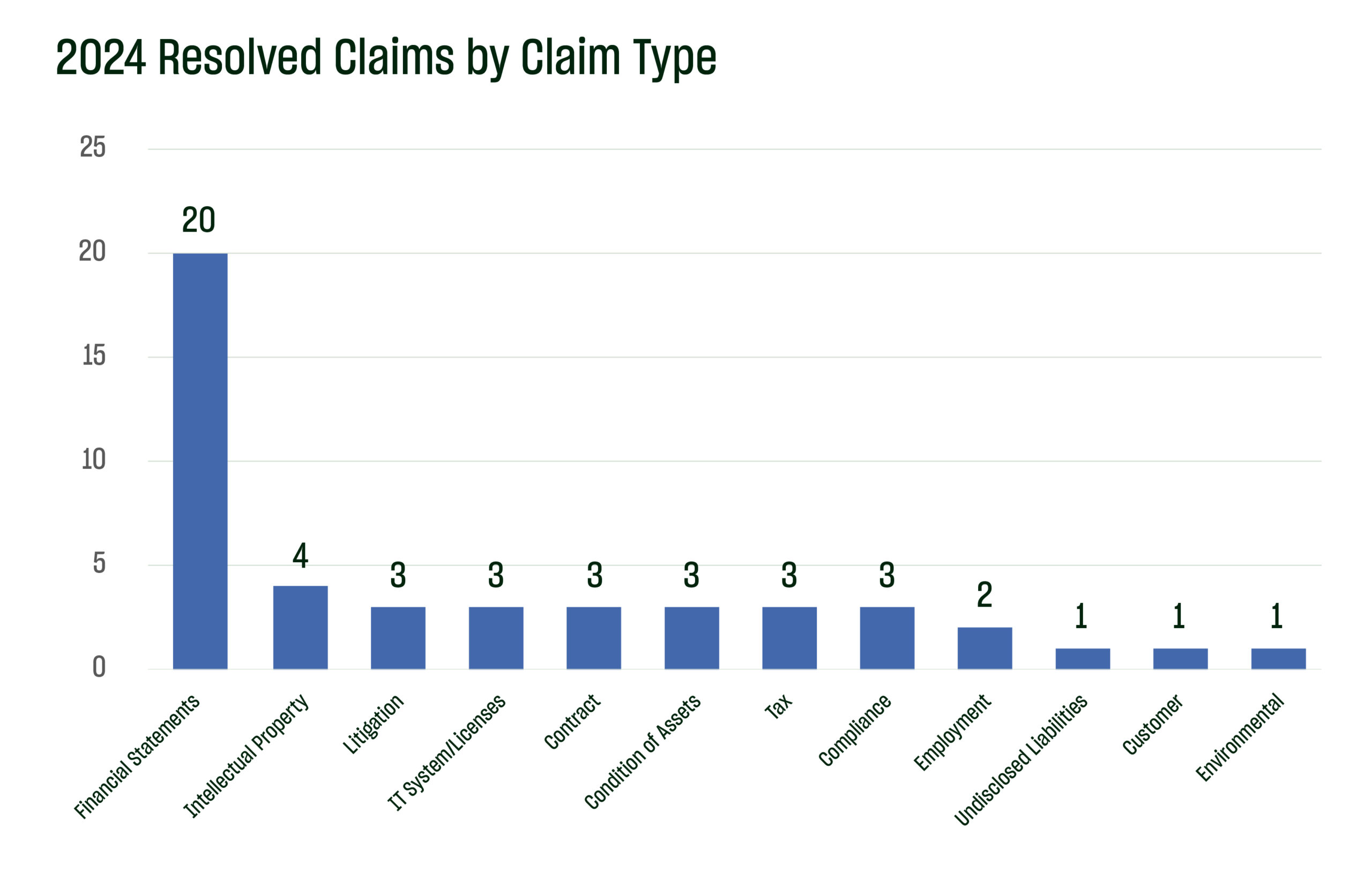

As shown in the graph below, in 2024 we paid a wide variety of claims. While inaccurate financial statements continue to be the most common basis for claims, accounting for about 43% of our 47 paid claims in 2024, we have seen an increase in the number of customer and tax claims, each representing about 15% of our total claims paid.

The elevated claims activity of the past year explains the need for sufficient rate in the transactional liability industry. If carriers are not making a reasonable margin on their business, they will not have the resources to invest in the claims teams necessary to keep up with the volume of claims that will inevitably be working their way through the market. While rates have ticked up from the unsustainable levels we called out in our 2024 claims study (which can be accessed here), we still feel the industry has a ways to go before rates are at a point where industry participants can feel comfortable that the premium going into the market is sufficient to cover the risks covered by our policies.

As we look ahead to 2025, we look forward to continuing to partner with our excellent clients, brokers, and carriers.