The following is a LinkedIn Article written by Jay Rittberg, Managing Principal at Euclid Transactional.

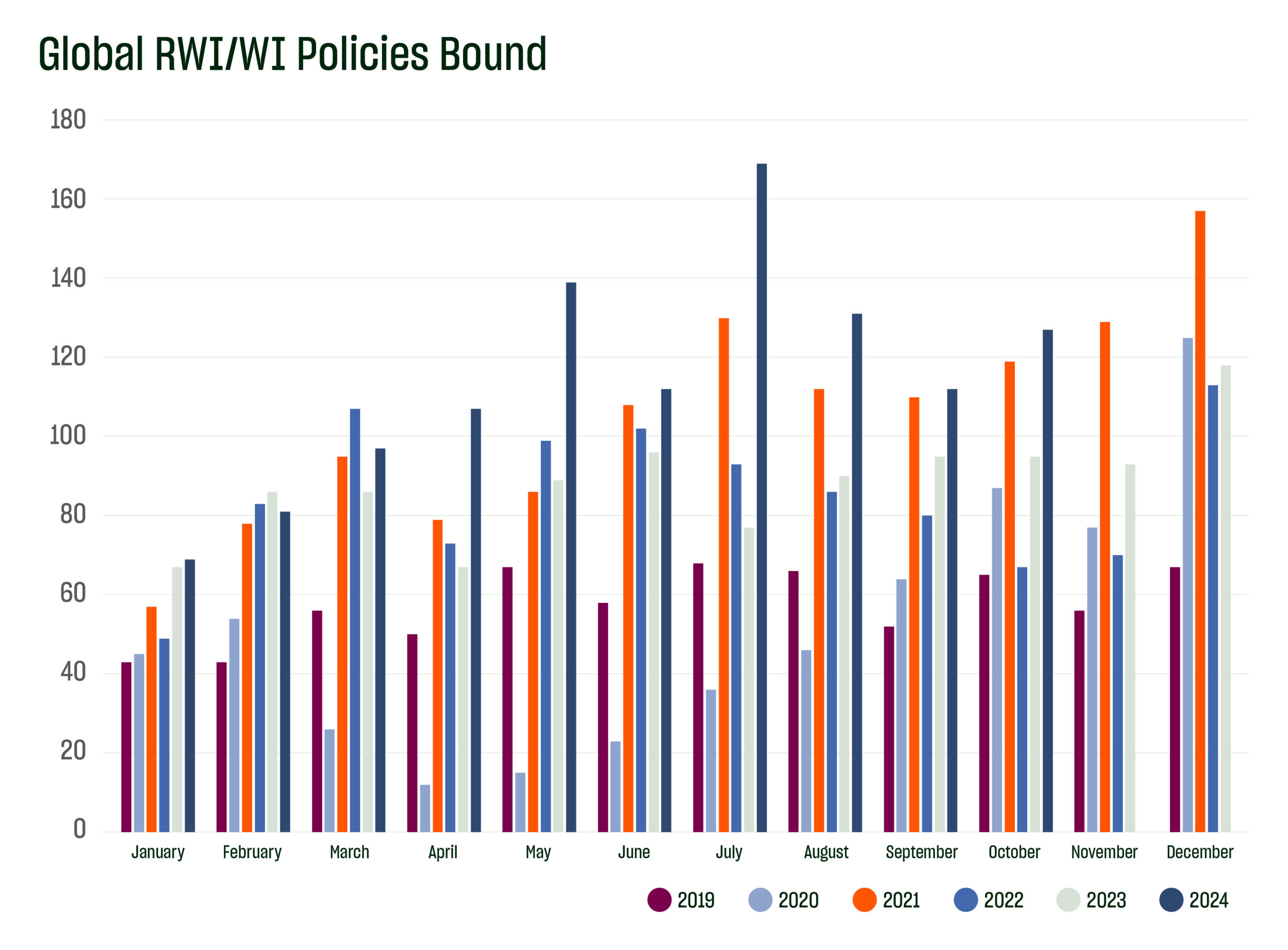

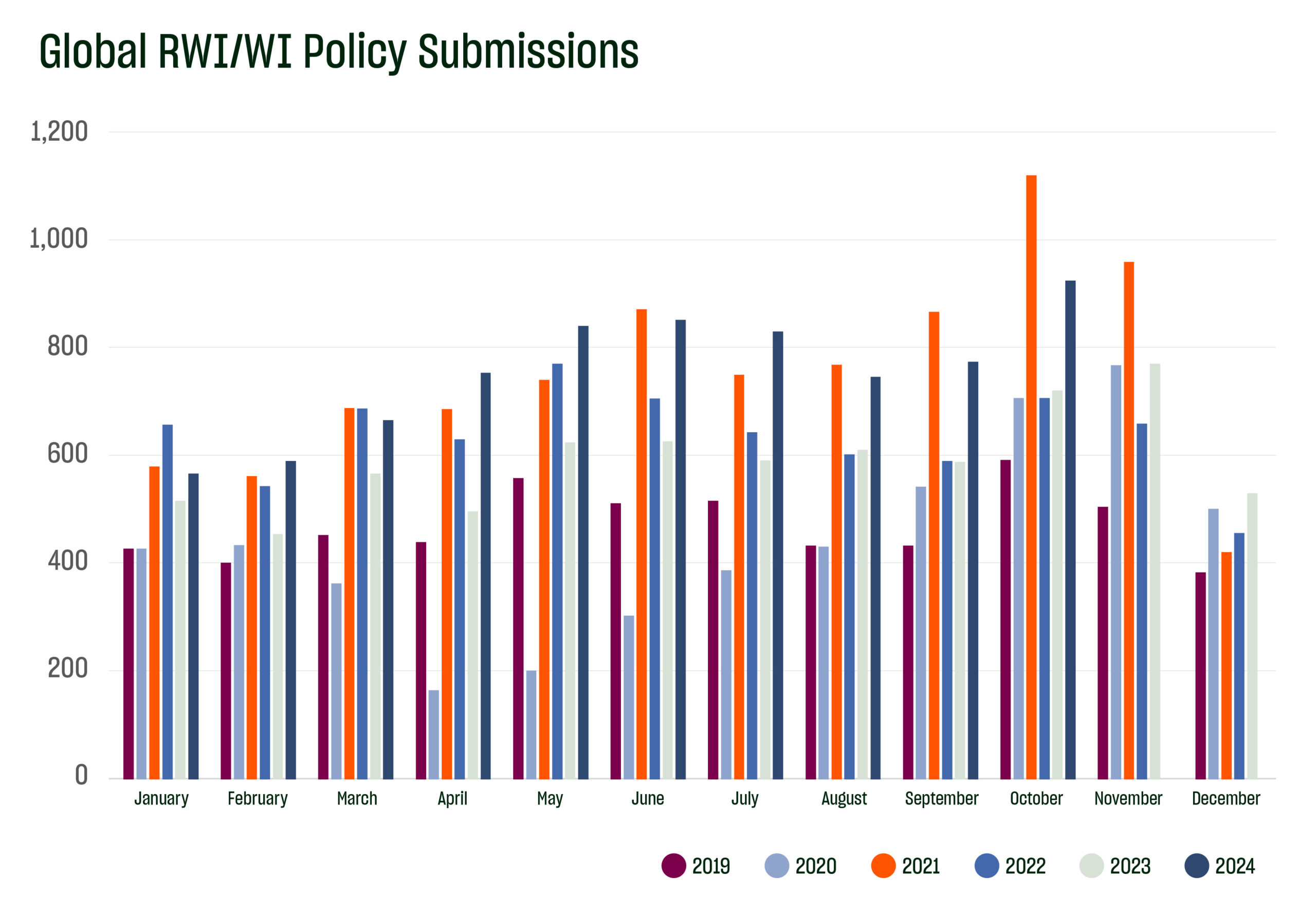

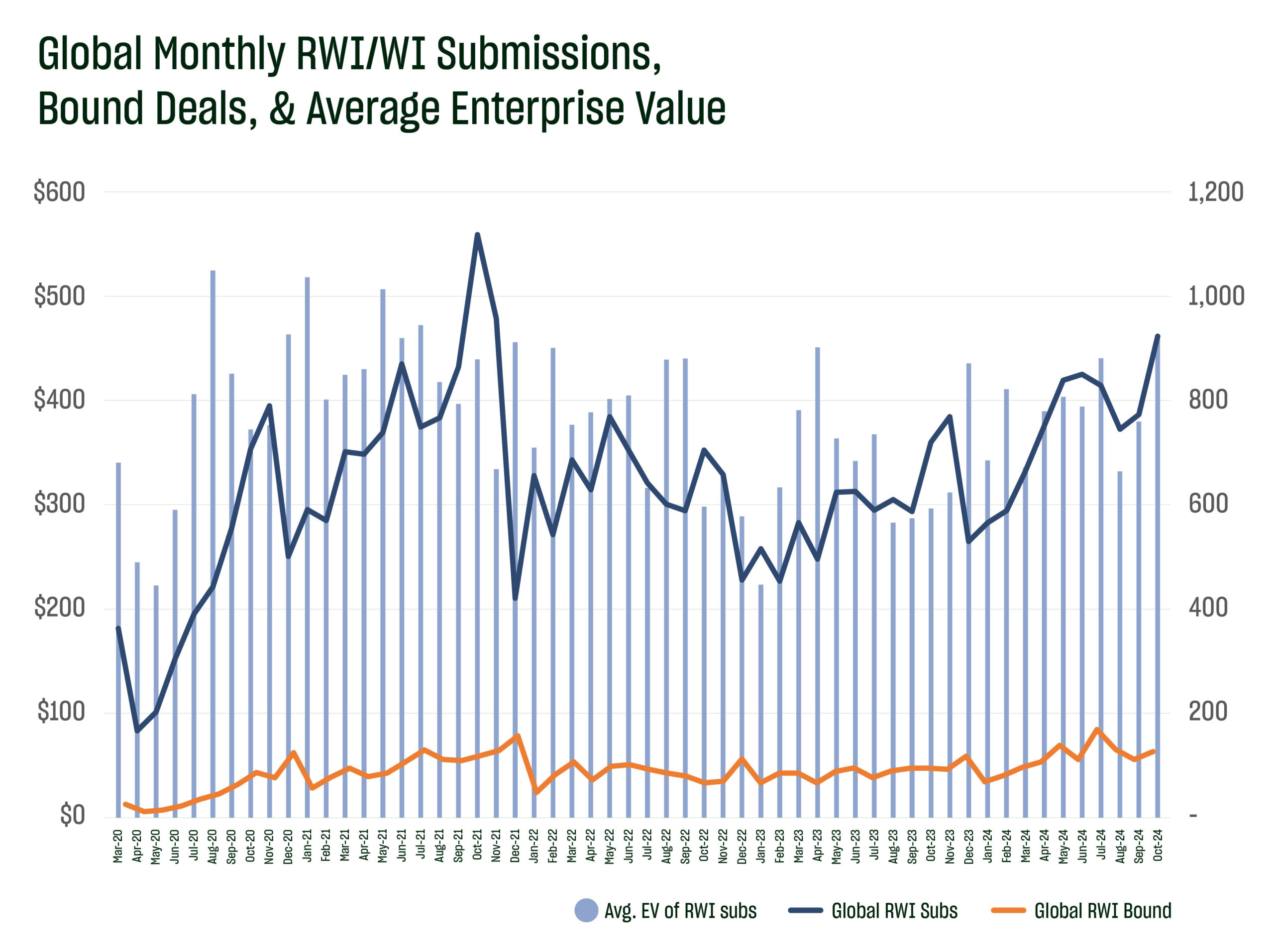

M&A stayed hot in October 2024 as Euclid Transactional saw monthly increases in submissions, bound deals and average deal sizes. We set a monthly record for October, binding 127 representation and warranty/warranty and indemnity insurance (RWI) policies globally, the 7th most for any month in our history. Regarding submissions, we saw our second strongest October on record, with 923 deals globally, our highest monthly total since November of 2021.

In addition to strong numbers of policies bound and record submissions, there has been a resurgence of deal values, as we saw the average enterprise value of submissions reach over $458 million, the highest monthly total since the scorching hot M&A market in the summer of 2021. The return of larger enterprise value deals is in line with trends noted in our prior post. With the stock market reaching all-time highs and recent interest rate cuts, our data is showing a healthy deal environment that we expect to remain highly active through the end of the year.

As deal size and submission volume remain robust, upward pressure on premium rates has begun to show signs of following, but industry rates remain well below what most experts believe to be profitable and sustainable. The transactional insurance industry has now paid billions of dollars in claims (with Euclid alone having paid over $935 million in claims since inception). We are thrilled to have recently released our 2024 Global RWI Claims Study. Our data underscores the importance of rate adequacy in the RWI industry, as we had seen rates reach historic lows earlier in 2024. Euclid will focus on the need for sustainable rate increases while continuing to offer the highest level of service in underwriting execution and claims handling to its partners in the M&A ecosystem.

Do our numbers align with your experiences in the M&A and RWI markets? What are your deal expectations for the remainder of 2024? Feel free reach out to Euclid Transactional to discuss these or any other topics.