The following is a LinkedIn Article written by Jay Rittberg, Managing Principal at Euclid Transactional.

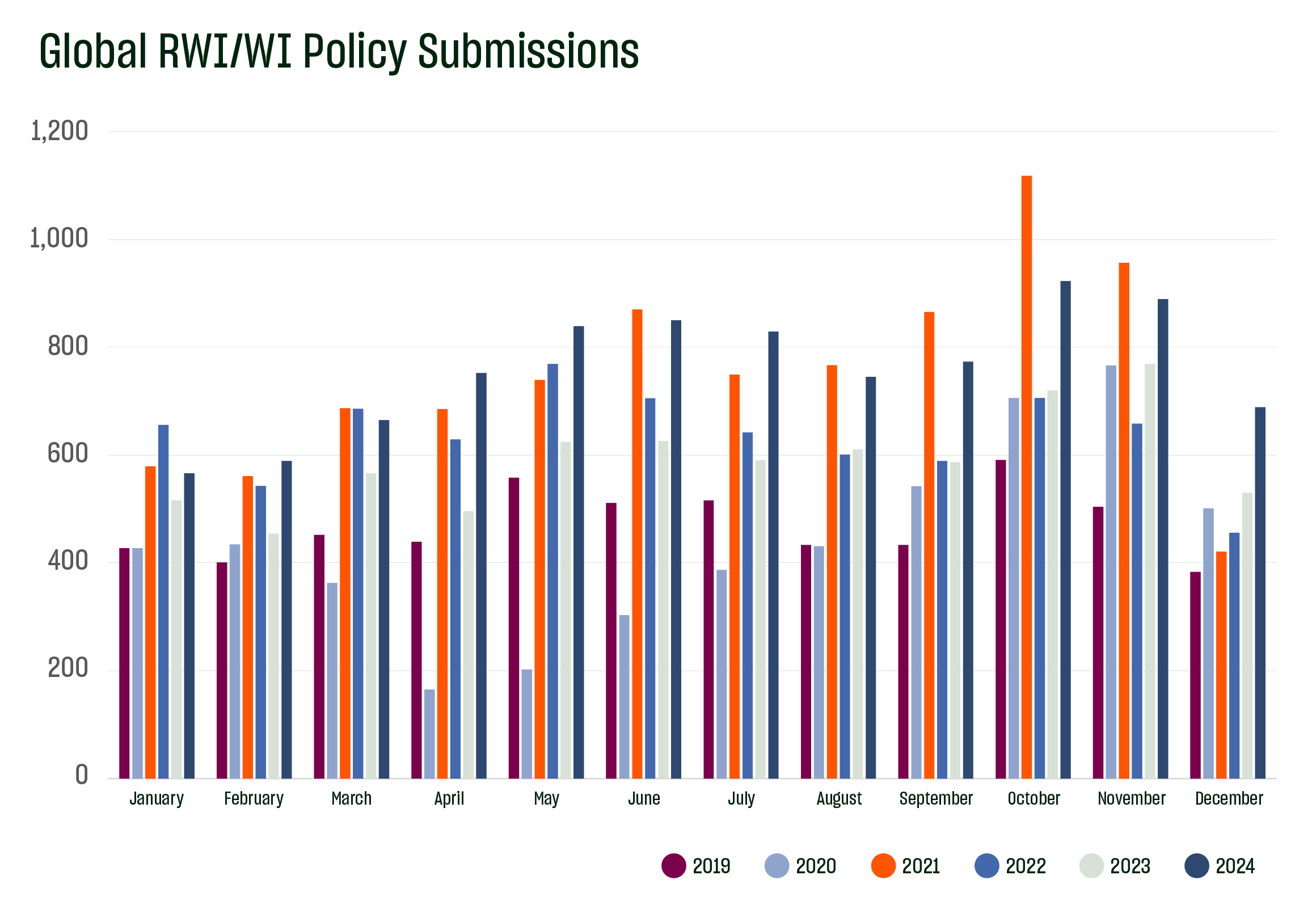

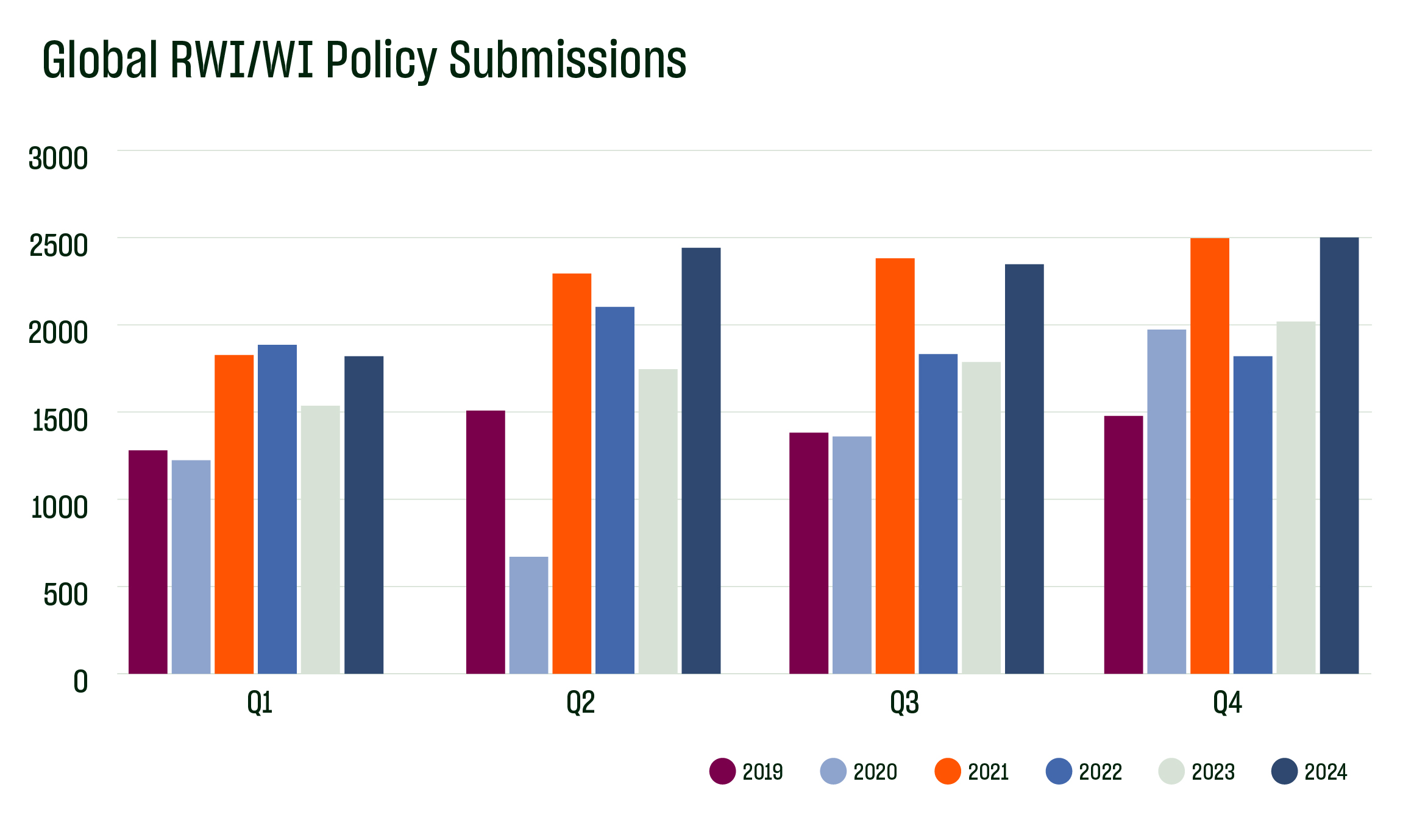

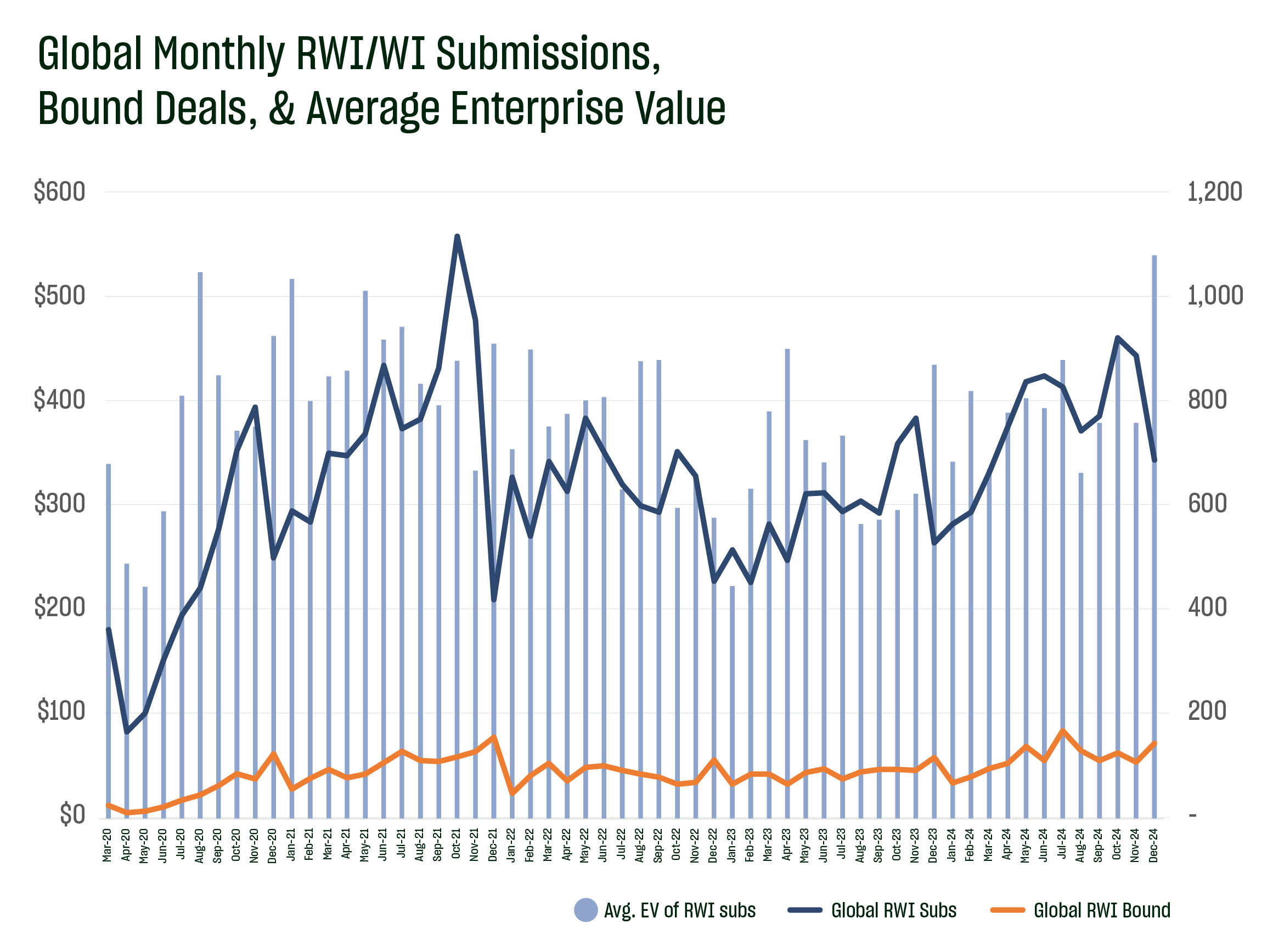

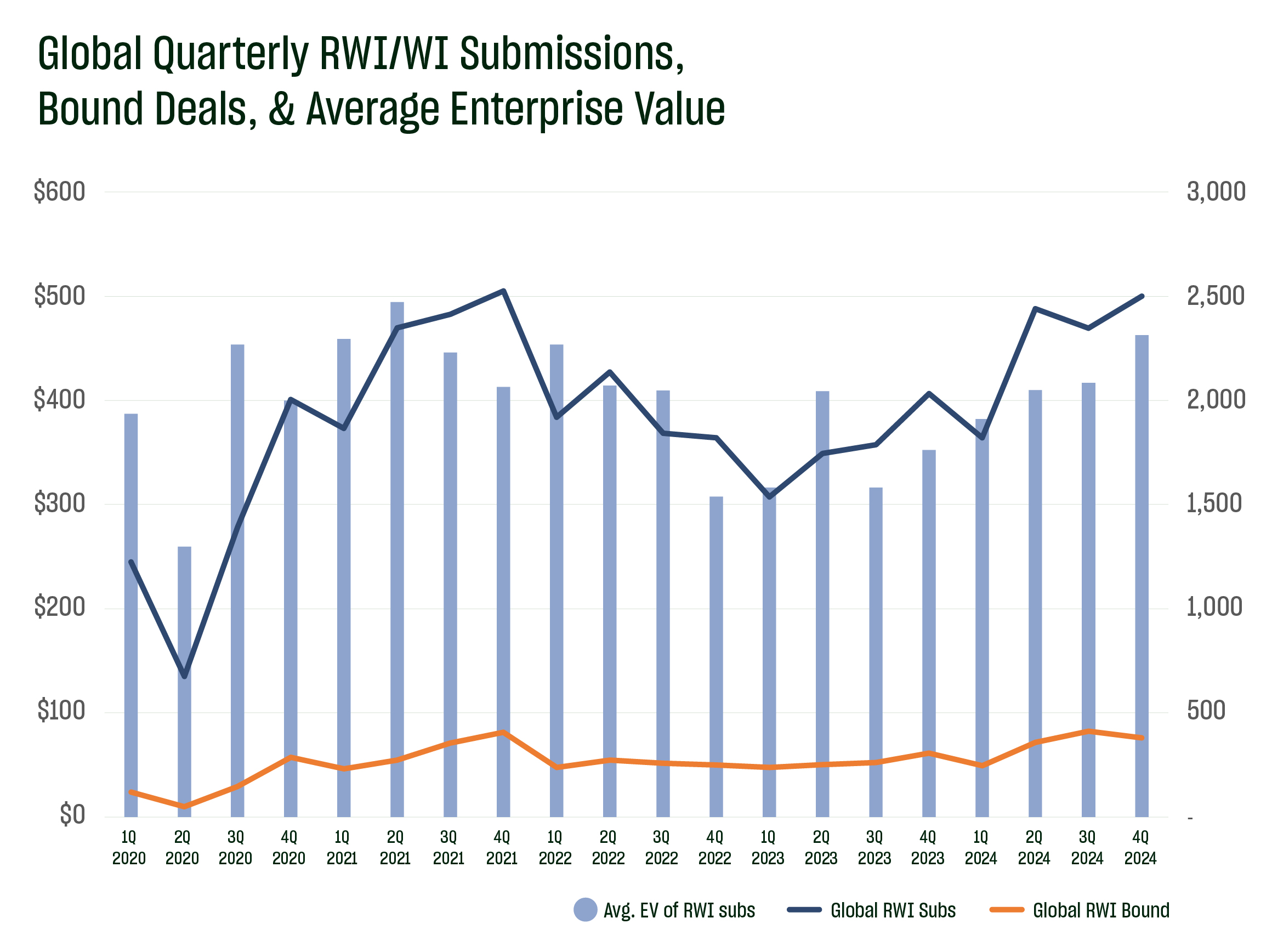

As we kick off 2025, Euclid Transactional‘s 4th quarter and December global numbers show a strong finish to 2024, fueling optimism that global M&A momentum will continue this year. Euclid Transactional received 689 representation and warranty/warranty and indemnity insurance (RWI) submissions globally in December and 2,501 submissions in Q4, our highest December and highest quarterly total on record. These numbers rounded out the busiest year for submissions in our history, eclipsing our previous high-water mark from 2021 by 1.2% and up 29% from 2023. As referenced in our prior post, a confluence of favorable factors, such as interest rate cuts and an anticipated softening regulatory environment, helped propel M&A activity to highs we haven’t experienced since the post-pandemic M&A surge.

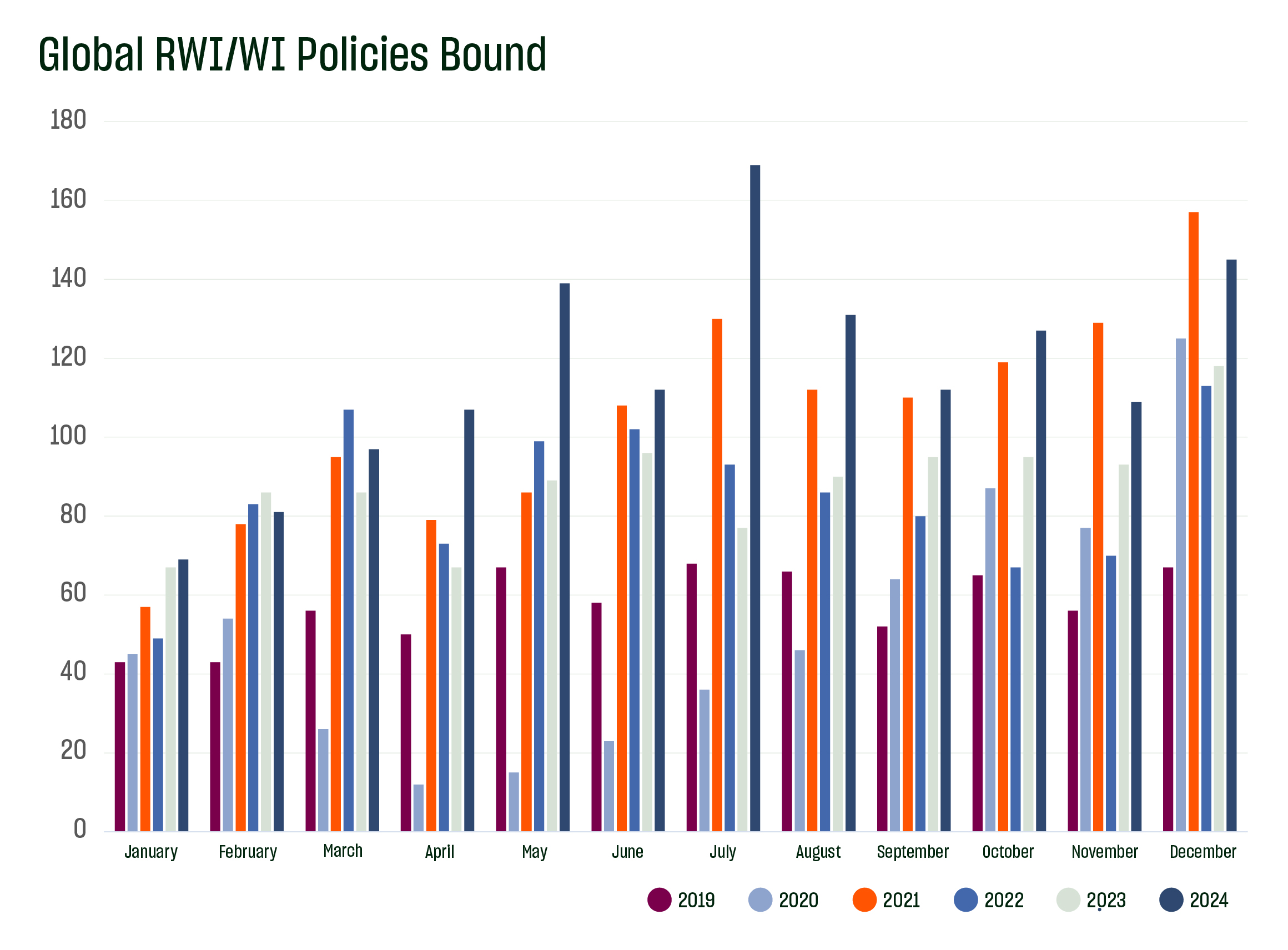

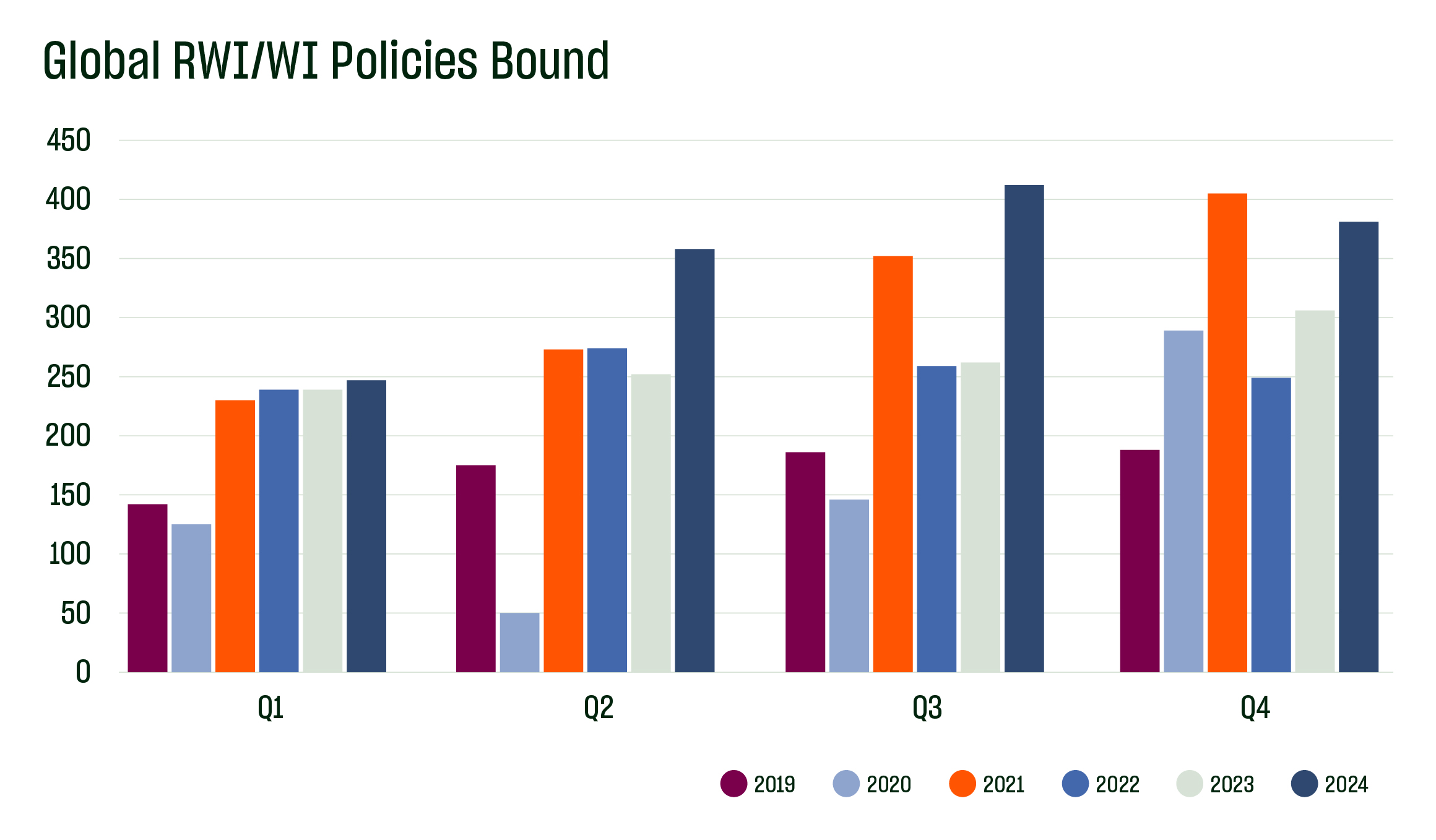

We bound 145 RWI policies globally in December, up 33% from November, making it our second most active policy month of the year and second most active December on record. The average enterprise value of submissions in December was $540M, up a whopping 42% over November and representing the highest monthly average enterprise value for RWI submissions in our history. This Q4 registered as our 3rd highest quarter for bound policies globally and second highest for average enterprise values ($462M versus $494M seen in Q2 of 2021). Two of the three highest quarters for number of RWI policies bound in our history occurred in 2024 (412 policies in Q3 2024, 405 policies in Q4 2021, and 381 policies in Q4 2024).

While this high level of deal activity has kept our underwriting team extraordinarily busy, our claims team has kept pace. We are extremely proud to be nearing $1 billion of claims paid and, as noted in our Year in Review, we paid over $300 million of claims in 2024 alone. Although we’ve seen aggregate premium rates trending upward, we’re still at levels well below what most industry experts believe to be profitable and sustainable. Given the claims severity and large loss data underlying our 2024 Global RWI Claims Study and as further highlighted in our recent claims update, RWI rates will need to meaningfully increase over the historic lows seen earlier in 2024 in order for the industry to continue to sustainably support clients with the claims service we believe they deserve. In 2025, Euclid will remain focused on the need for rate increases while continuing to offer the highest level of service in underwriting execution and claims handling to its partners in the M&A ecosystem.

Do our numbers align with your experiences in the M&A and RWI markets? What are your expectations for M&A in 2025? Feel free reach out to Euclid Transactional to discuss these or any other topics.