The following is a LinkedIn Article written by Justin Berutich, Managing Director and Head of Tax at Euclid Transactional.

2024 was a year of growth and milestones for the global tax team at Euclid Transactional – and we believe the tax insurance industry is entering 2025 with significant momentum.

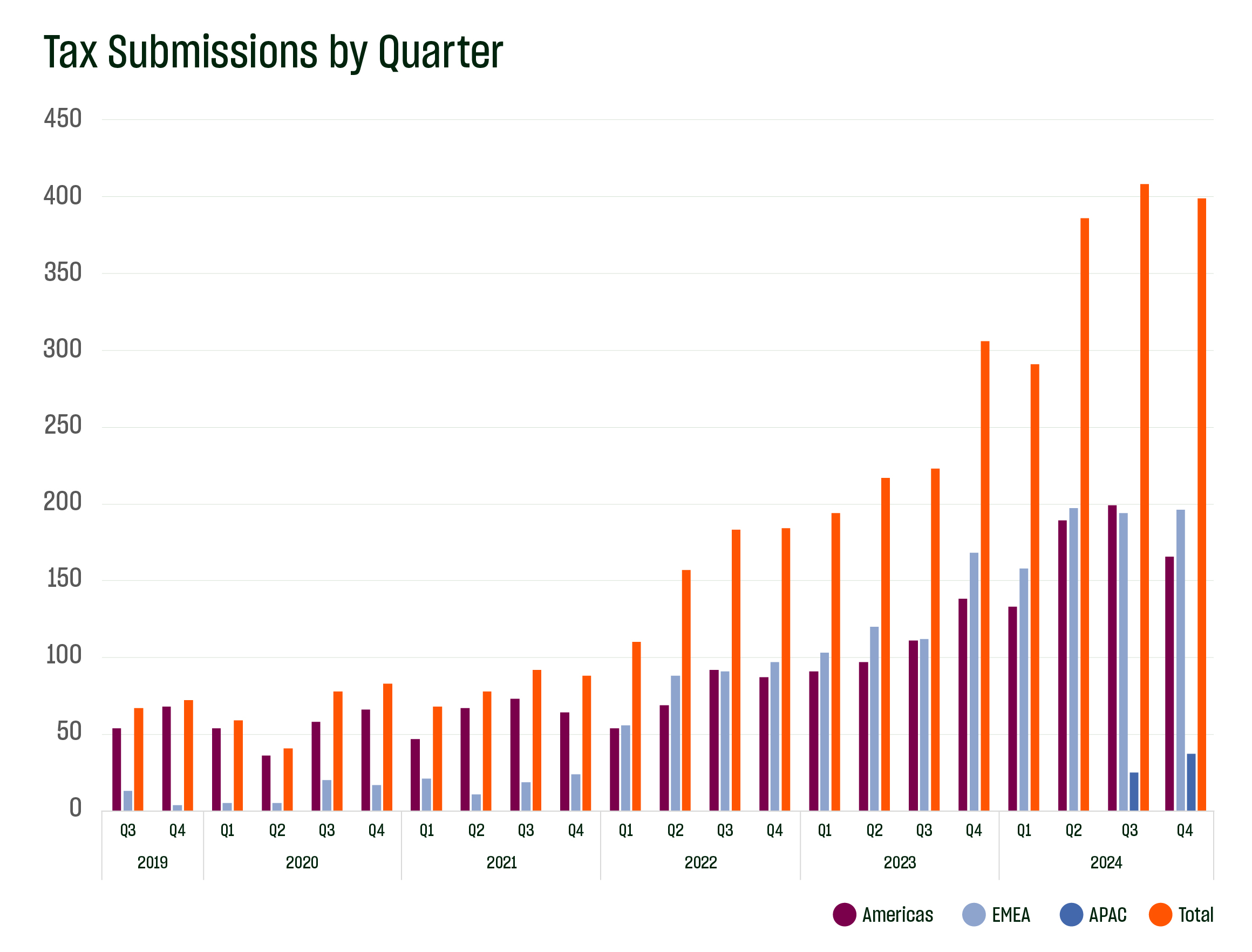

Euclid saw a record 1,494 tax submissions globally in 2024, beating the previous record set in 2023 by nearly 60%. North America and EMEA saw 694 and 736 tax submissions respectively in 2024, representing year over year growth of 58% and 47%, respectively. Launched in August of 2024, our APAC team fielded 64 tax submissions in the second half of the year, leading us to believe that the future of tax insurance is bright in the Asia Pacific region.

A significant driver of the North American growth is increased investment in renewable energy. Historically, renewable energy opportunities accounted for ~30% of total tax submissions. This changed after the passage of the Inflation Reduction Act (IRA) in late 2022. Since then, the volume of renewable energy opportunities has grown significantly, accounting for nearly 50%, and 60%+ of total North American tax submissions in 2023 and 2024, respectively.

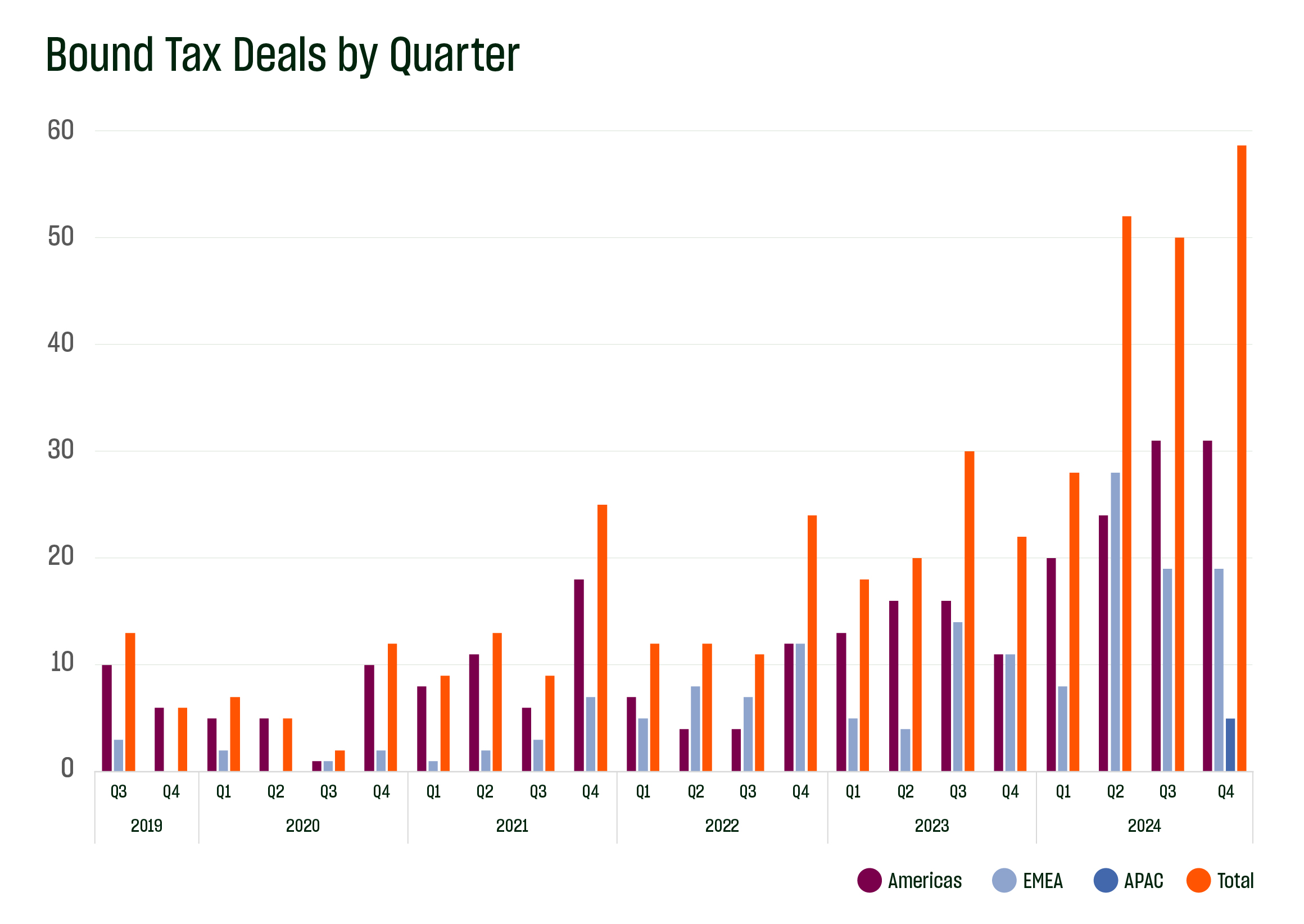

Our team’s expertise, global reach, and dedication have helped convert the record submission volume into bound policies. We consistently find that, when tight timelines and execution concerns drive deal decisions, Euclid wins an outsized share of new engagements. We believe this is due to our 14-person tax team, with decades of combined experience, which excels in delivering under pressure.

Our global tax team collectively bound 187 policies in 2024, beating the previous record set in 2023 by over 100%. North America saw bound policy growth of over 97% in 2024, while EMEA’s policy count grew by 125%. Since Euclid’s first tax policy in 2018, we have now helped bind over $12 billion in policy limits.

As we enter 2025, our team continues to closely monitor developments in Washington D.C. While we anticipate significant tax changes this year, including an extension of many of the Tax Cuts and Jobs Act provisions, it is our belief that any repeal of IRA provisions will be done with a scalpel as opposed to a sledgehammer, sparing most projects currently under construction, while sunsetting the expiration dates earlier than originally planned. However, nothing is certain in Washington and only time will tell.

Do our numbers align with your experiences? Reach out to Euclid Transactional to discuss these or any other topics.