The following is a LinkedIn Article written by Jay Rittberg, Managing Principal at Euclid Transactional.

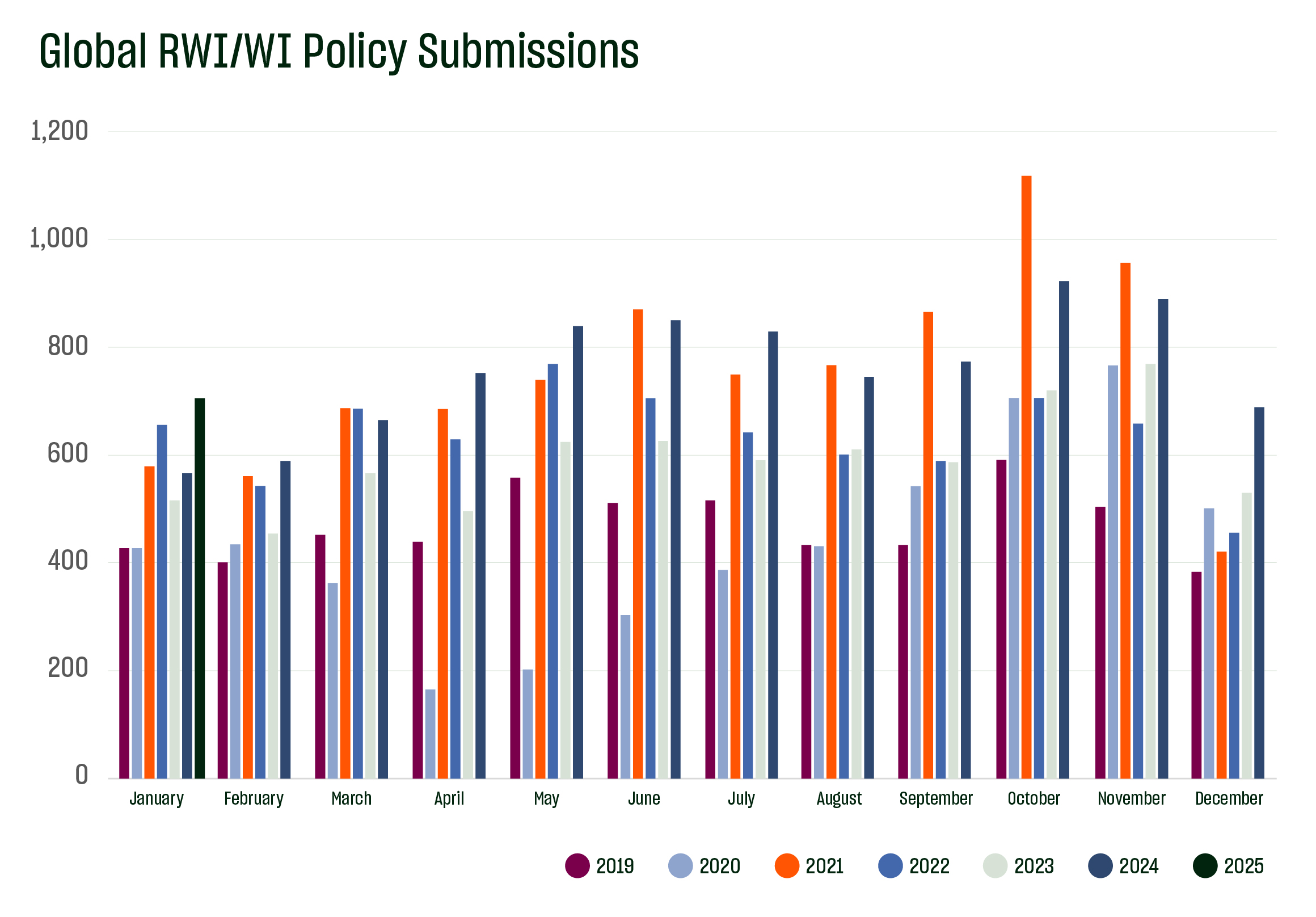

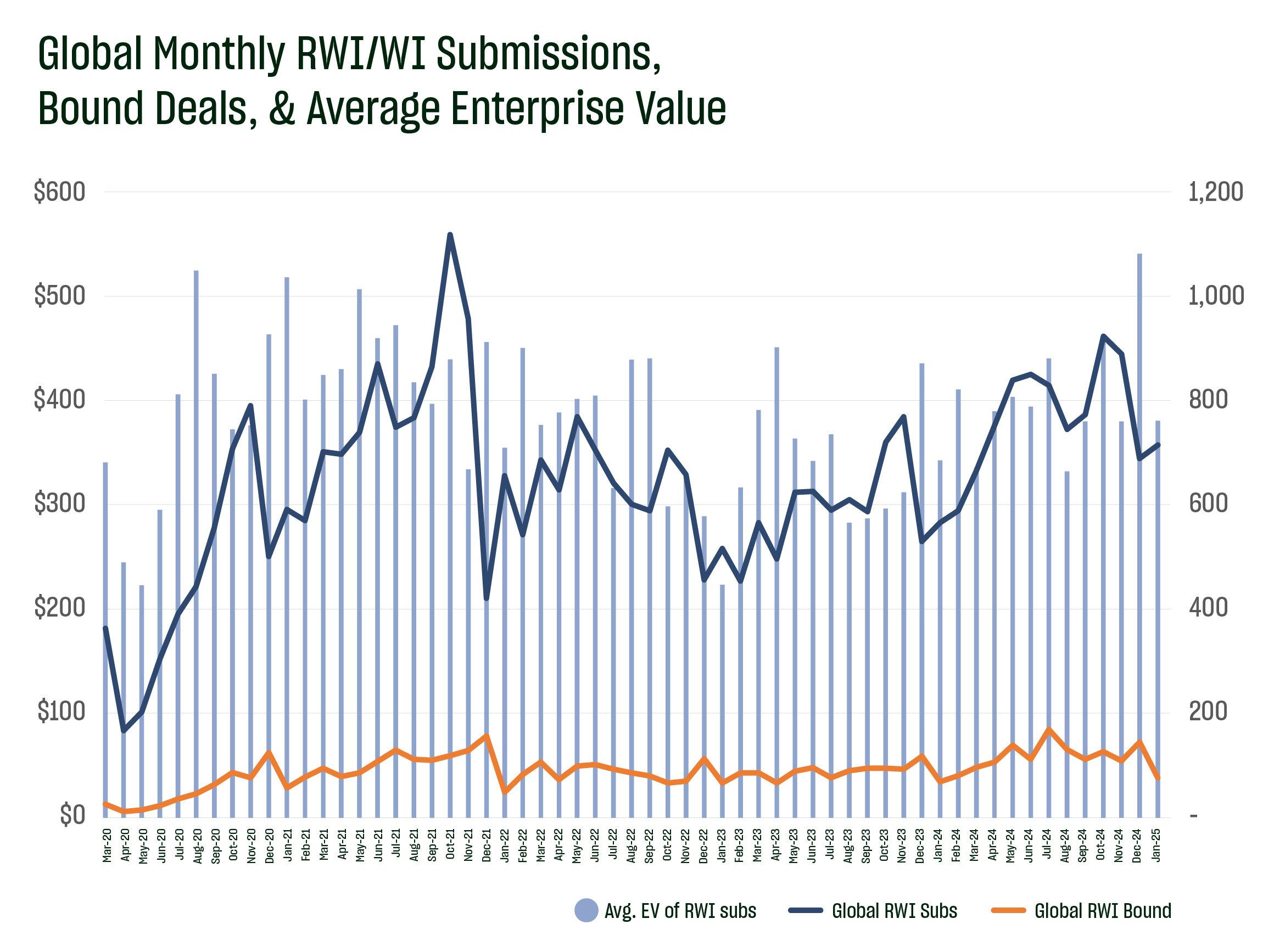

Q4 2024 was one of the most active M&A quarters in recent memory – will that momentum continue in 2025? Euclid Transactional received 715 representation and warranty/warranty and indemnity insurance (RWI) submissions globally in January, our highest January on record, showing a 26% increase over last January and a 9% increase over the highest previous total in January of 2022. This is a strong start coming off the busiest year for submissions in our history. Our prior post referred to multiple favorable factors in Q4 2024, such as interest rate cuts and an anticipated softening regulatory environment, which propelled M&A activity to new highs. The bullish sentiment of the past two quarters may now be softening into cautious optimism, driven by tariff threats from the new presidential administration and mixed signals related to inflation and other macroeconomic indicators.

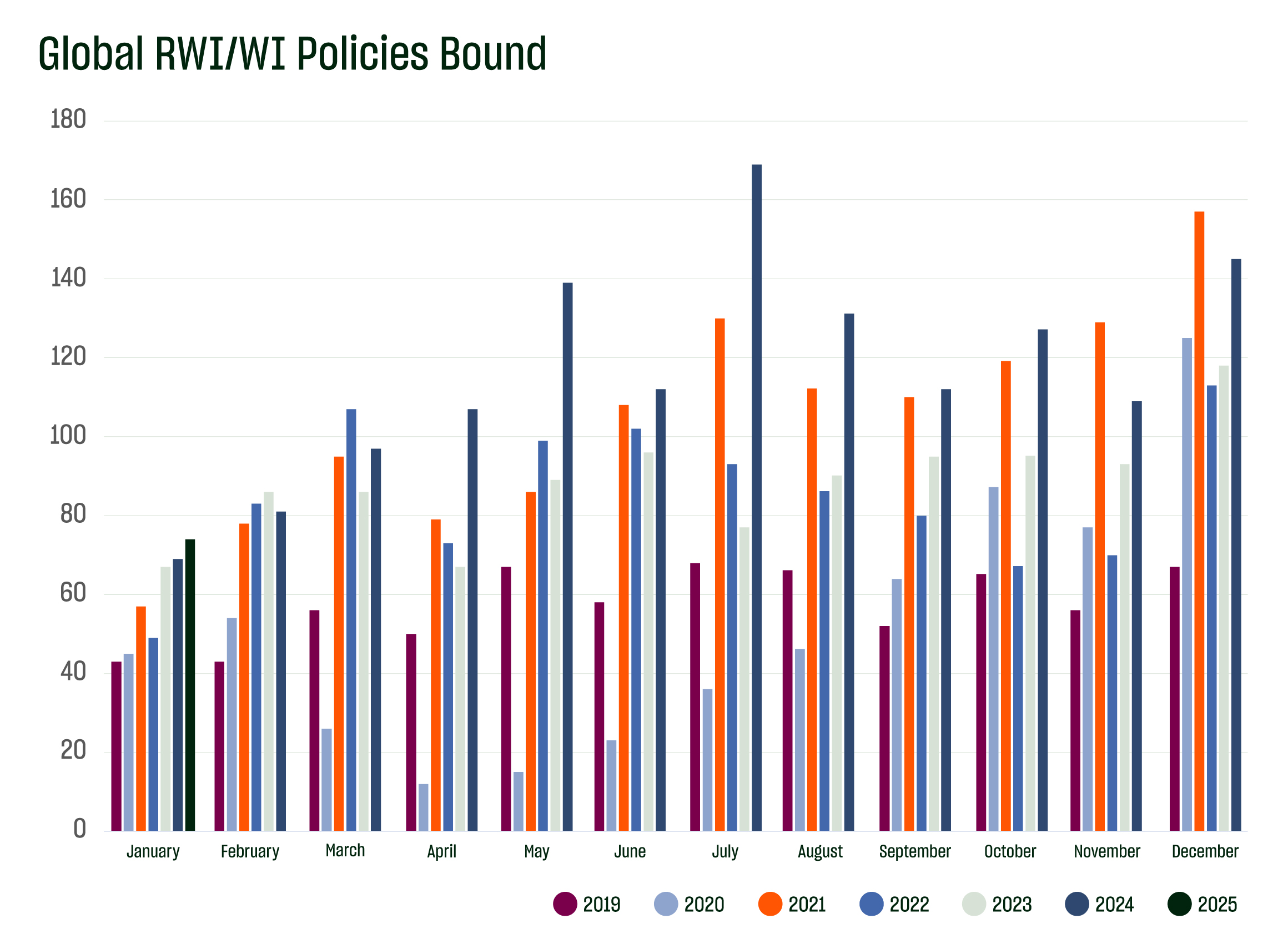

We bound 77 RWI policies globally in January, up 12% from last January’s results, making it the most active January in our history. The global average enterprise value of submissions in January was down 29% from last month to $380m, coming off our highest monthly EV on record in December.

We are extremely proud to be nearing $1 billion of RWI claims paid. This number demonstrates our commitment to fair and efficient claims handling. In 2024 alone, we paid over $300 million in claims. While aggregate premium rates have been rising, they remain well below the levels most industry experts consider profitable and sustainable. Our 2024 Global RWI Claims Studyhighlights the increasing severity of loss payments, underscoring the urgent need for meaningful and lasting upward rate movement. In 2025, Euclid will continue advocating for necessary rate increases while remaining dedicated to providing exceptional underwriting execution and claims handling for our partners in the M&A ecosystem.

Do our numbers align with your experiences in the M&A and RWI markets? What are your expectations for M&A in 2025? Feel free reach out to Euclid Transactional to discuss these or any other topics.