The following is a LinkedIn Article written by Jay Rittberg, Managing Principal at Euclid Transactional.

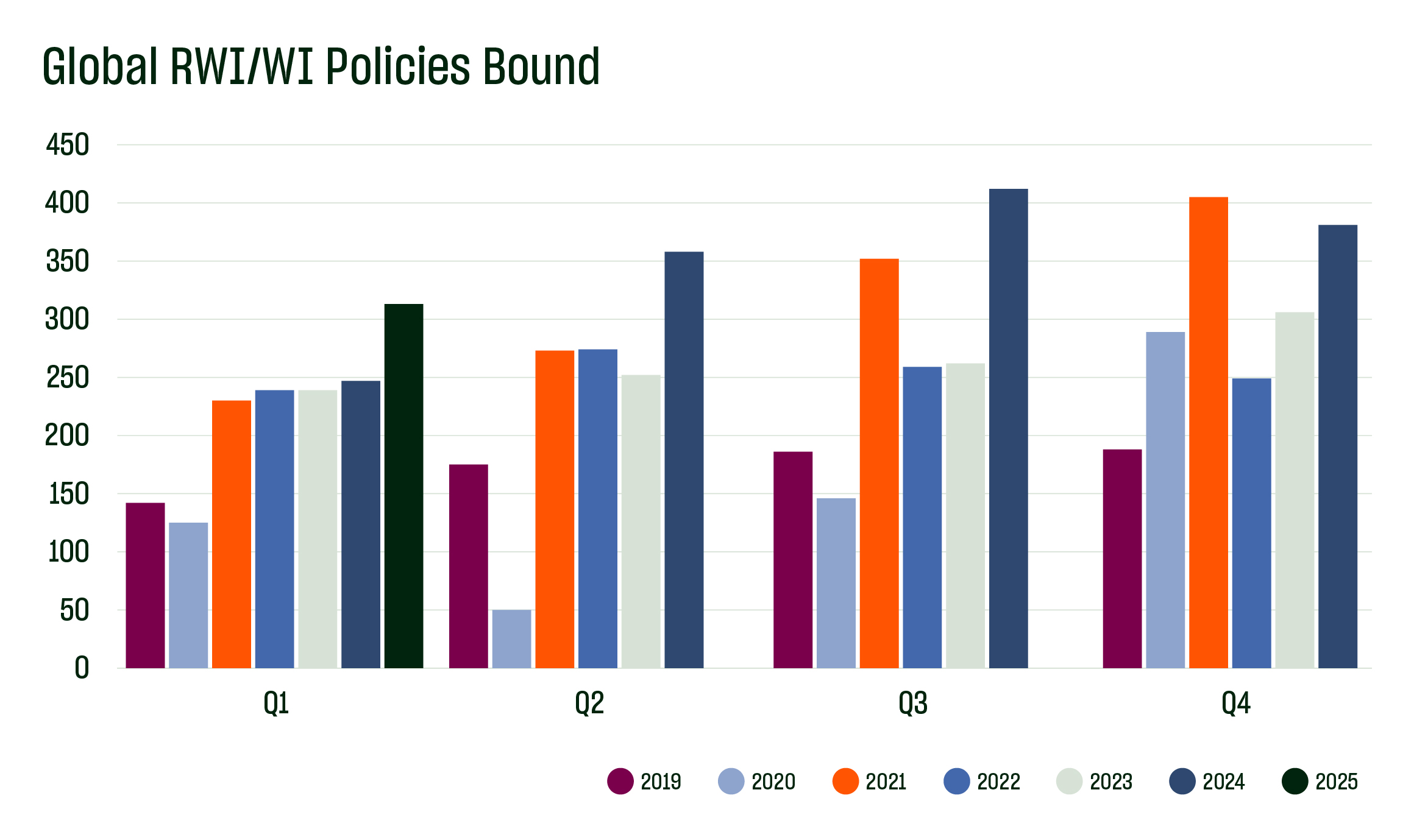

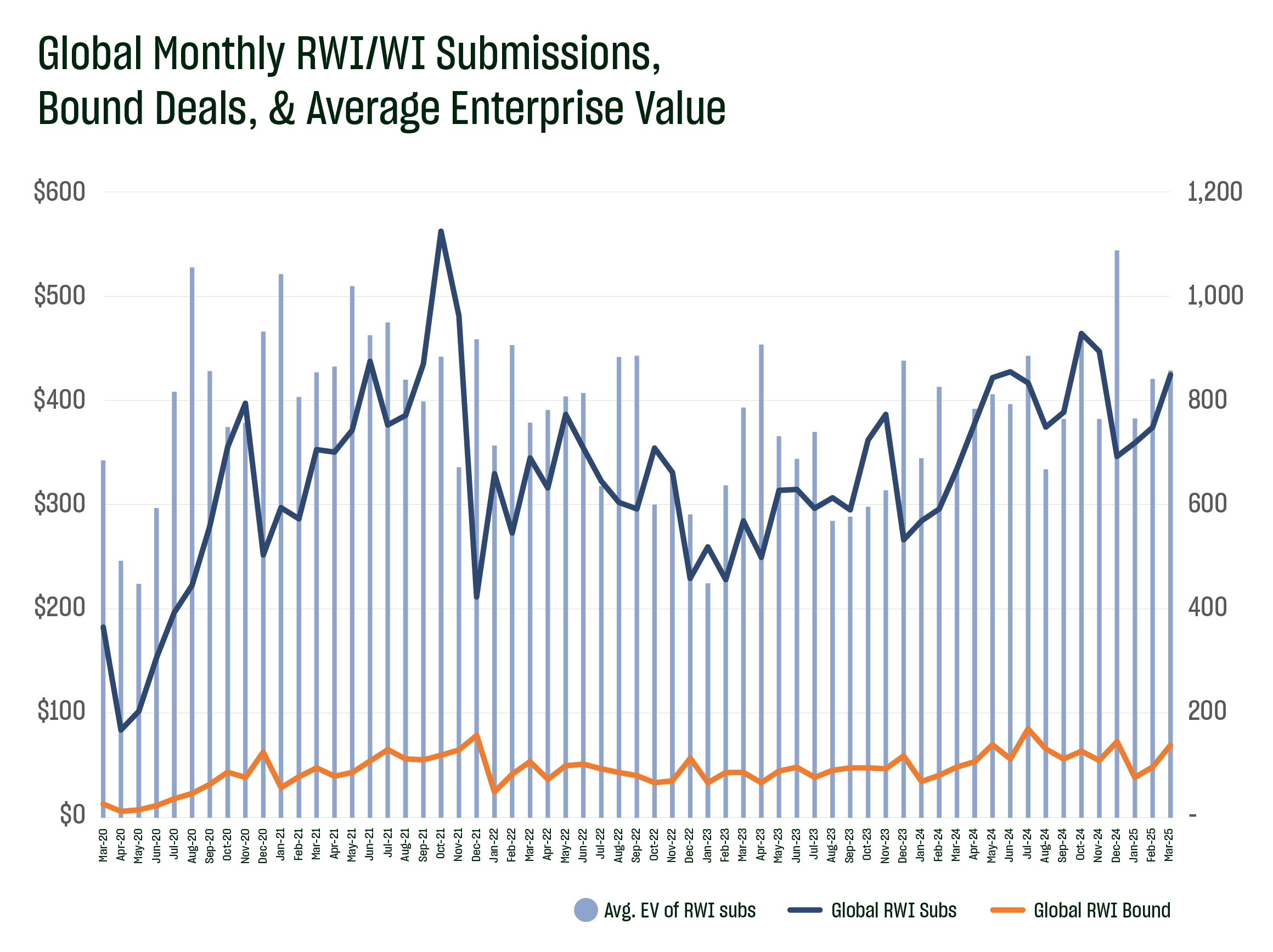

Our March 2025 representation and warranty/warranty and indemnity insurance (RWI) data suggests a surprisingly resilient M&A market thus far as buyers and sellers continue to monitor and internalize the impact of US tariff announcements and market volatility. While average enterprise values and policy bindings in Q1 2025 decreased from levels seen over the second half of 2024 (which had contributed to optimism for a banner year in 2025 for M&A before macro headwinds set in), in some cases, business is at the highest level we have seen in any prior Q1 in our history.

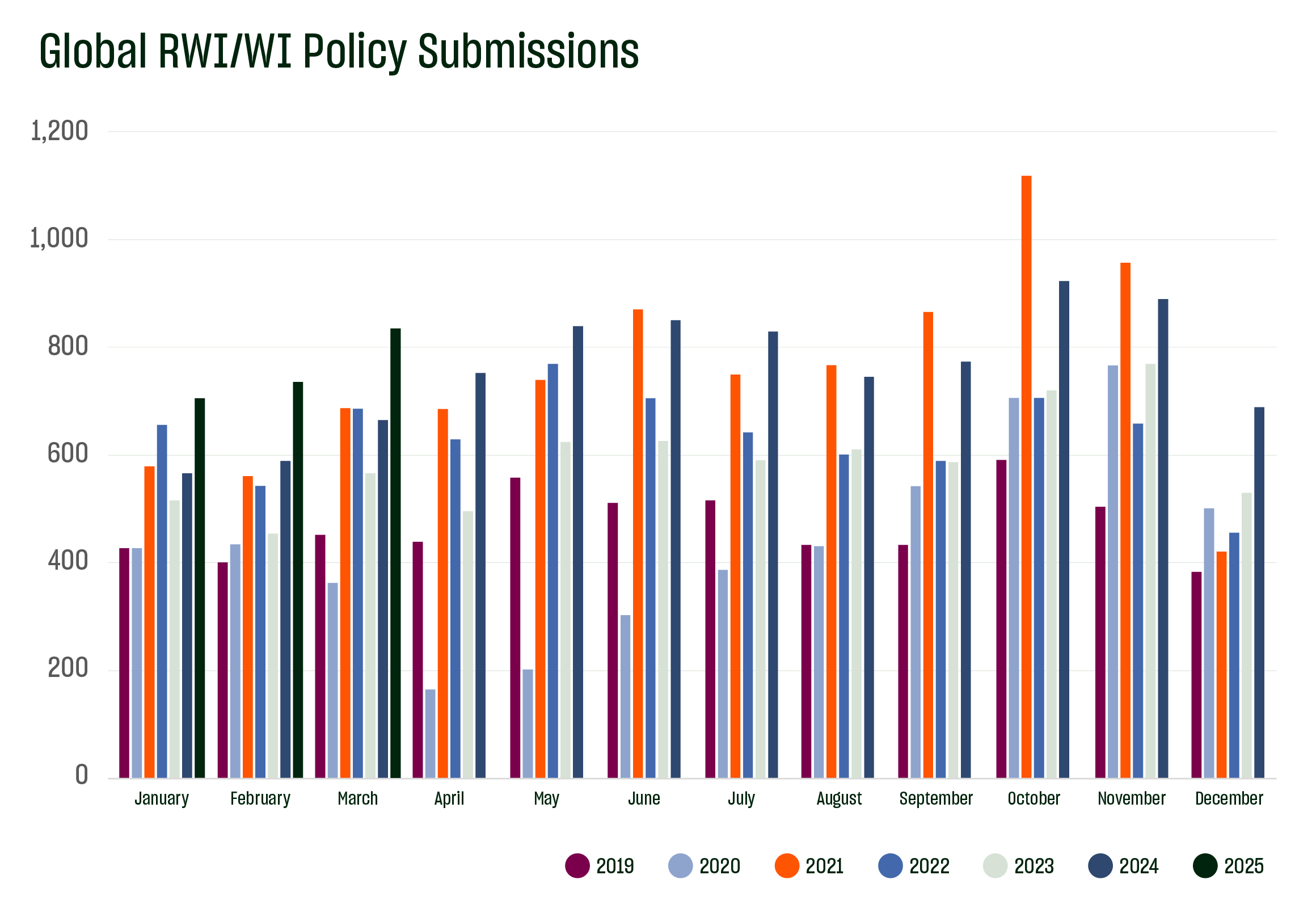

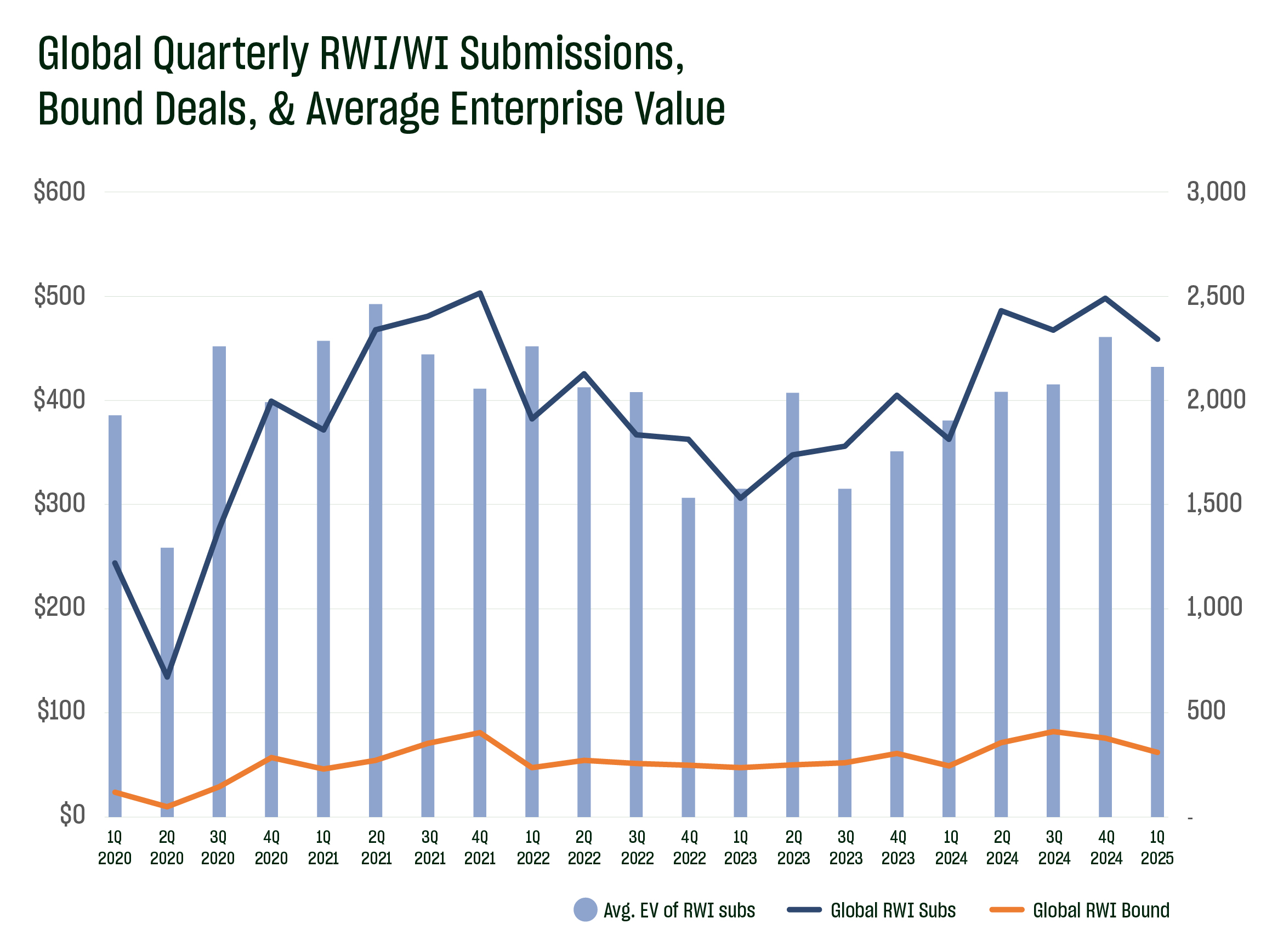

Euclid Transactional received 844 RWI submissions globally in March, our highest March on record. We received 2,303 RWI submissions globally for Q1 2025, which is less than each of Q2-Q4 last year but is 27% higher than Q1 2024 and is our highest Q1 submission activity on record. The average enterprise value of global RWI submissions for March was $426.29M, down 21% from December 2024’s record of $540M, but represents the highest average for any March in our history. The average enterprise value of global RWI submissions for Q1 2025 was $433.99M, down 6% from Q4 2024 but is the highest Q1 average we have seen since Q1 2022.

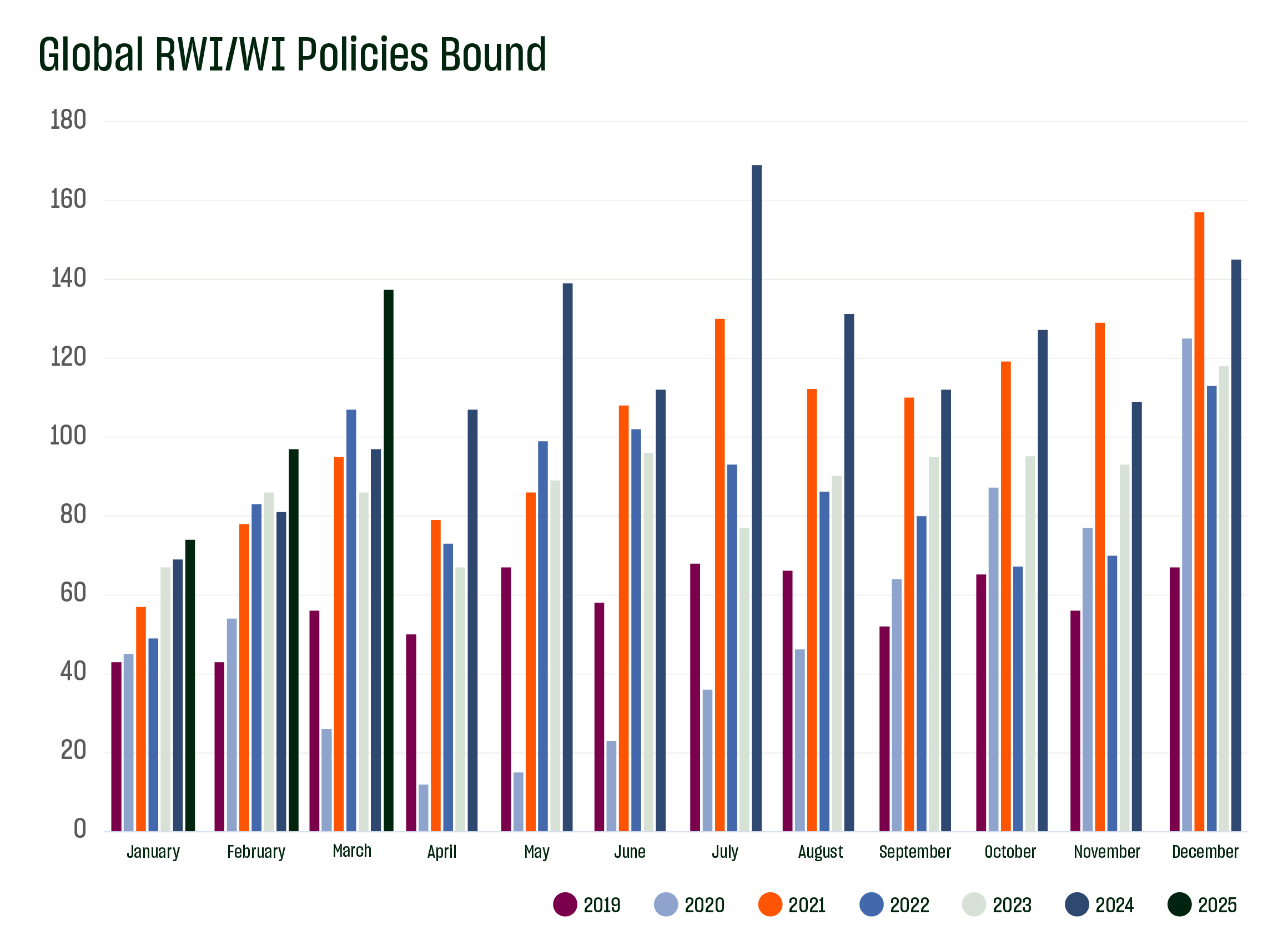

Euclid Transactional bound 138 RWI policies globally in March, up 42% month over month and the highest number of global bound deals in any March in our history. For Q1 2025, we bound 312 RWI policies globally, which is less than each of Q2-Q4 2024 but a 27% increase over Q1 2024 and the highest number of bound RWI policies globally for any Q1 in our history.

This data suggests that M&A activity has been reasonably robust compared to a typical first quarter, but is at a tempered level compared to the active M&A market observed during the second half of 2024. We expect that submission volume and deal signings may further slow down as buyers and sellers analyze how tariff announcements will factor into their expenses and valuations.

Euclid Transactional remains focused on increasing and maintaining RWI rates on line to continue to deliver the exceptional underwriting service and fair and efficient claims process for which we are known. We proudly announced in our prior post that we have eclipsed $1 billion in RWI claims paid in less than 9 years of operation, including $300 million in RWI claims paid in 2024 alone. While aggregate premium rates have been rising in 2025, they remain below the levels most industry experts consider profitable and sustainable. Our 2024 Global RWI Claims Study highlights the increasing severity of loss payments, underscoring the urgent need for meaningful and lasting upward rate movement.

Do our numbers align with your experiences in the M&A and RWI markets? What are your expectations for M&A in the remaining three quarters of 2025? Feel free reach out to Euclid Transactional to discuss these or any other topics.