We are pleased to present Euclid Transactional’s first Global Representations and Warranties Insurance (RWI) Claims Study.

View/download the North America version of the study here.

View/download the EMEA version of the study here.

Many hours went into the deals, policies, and claims that underlie this data, and we are grateful for the collaborative work by our colleagues, clients, brokers, lawyers, advisors and insurance carriers that made this study possible.

Euclid Transactional was founded in 2016 with a vision of building an independent managing general agent with the scale required to provide our clients, brokers, and lawyers with the service they demand, while also creating a supportive environment to attract and retain the most talented team in the industry. Today, we believe we are the largest underwriter of transactional insurance in the world, backed by some of the most highly rated global insurance carriers. Euclid Transactional has close to 150 employees across 10 offices, having hired over 60 underwriters and claims handlers with minimal turnover. We hope this continuity gives our clients the comfort of knowing the people they dealt with when they placed the policy, who understand the context of the deal the policy relates to, will likely be around if a claim arises.

Our claims team has also grown to be the largest in the industry, with over 20 professionals dedicated full time to handling claims. Dozens of others at Euclid Transactional, including underwriters and accounting experts, also lend expertise to the claims process where appropriate.

Euclid Transactional strives to deliver thoughtful, efficient, and friendly underwriting and claims handling, and we take great pleasure in trying to exceed our clients’ expectations.

The industry is at an interesting time in its business cycle. Although we are receiving claims in record numbers, pricing of RWI is approaching an all-time low.

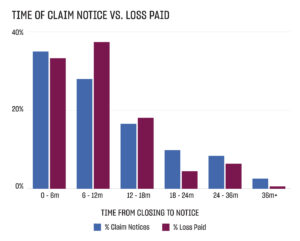

The surge in claims is expected. During the busy period from the second half of 2020 through the first half of 2022, an estimated $250 billion of transactional liability limits were placed into the market. The claims from that high-volume period are still making their way to us and we expect the number of claim notices we receive to remain elevated throughout 2024. In fact, we received the most claims we had ever received in a month in July 2023, the month after the data for this study was finalized.

Meanwhile, premiums for RWI have decreased dramatically. Deal volume, particularly with respect to larger deals, has dropped from the peaks of 2021 as rising interest rates led to a challenging lending environment and a mismatch in pricing expectations between buyers and sellers. With less deals to insure, rates in the RWI market have decreased throughout 2023. We are monitoring this trend closely, as adequate rate is required to underwrite profitably. We are hopeful that the uptick in deal submissions we have seen in recent weeks will be the beginnings of a robust M&A cycle.

Thank you again to each of our employees, clients, brokers, lawyers, advisors, and insurance carriers. We look forward to continued partnership through whatever conditions the market will bring us in 2024 and beyond.