2022 was another great year for Euclid Transactional’s global claims team as we continue to ensure that the size, experience and quality of the team, and its deep connection to our underwriters, allows us to deliver the most consistent, thoughtful, and proactive claims process possible to our clients.

Headline Claims Figures

- The team resolved 29 claims in 2022 resulting in payments totaling over USD 139.27 million (which is nearly USD 55 million more than in 2021).

- This included USD 25 million on excess policies.

- Since we started underwriting in late 2016, Insureds have received payments of more than USD 500 million in indemnified loss under policies issued by Euclid.

Our Claims Team

We believe we have the largest dedicated claims team in the transactional insurance industry, with 20 full-time professionals:

- In June 2022 we added 2 claims handlers, a claims analyst, and a claims associate to our New York team and 1 claims handler in EMEA.

- As of March 2023, our first Canada-based claims handler has joined the team — we believe he is the first fully-dedicated transactional insurance claims handler in Canada.

Our claims team is led by Meg Gardiner, Chris Ziemba, Brittany Zimmer (in New York) and Daniella Smith (in EMEA) and is bolstered by its partnership with Euclid’s experienced underwriting team through Euclid’s Underwriting and Claims Committee (the “UWCC”). The UWCC meets regularly to exchange analysis and ideas to improve both claims and underwriting processes and, along with specific deal underwriters, is actively involved in claims servicing and support.

Our Experience in 2022

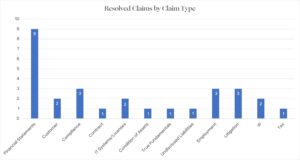

As shown in the graph below, in 2022 we paid a wide variety of claims, including in relation to intellectual property infringement, representations regarding customers of acquired companies, tax, and employment-related issues.

Inaccurate financial statements continue to be a common basis for claims, accounting for 9 of our 29 paid claims in 2022 (over 30%).

In just one example of the efficiency of our process, the largest claim we paid in 2022 was also one of our fastest-moving. This was a complex claim, involving breach of a customer contract and non- compliance with law, and had significant uncertainties regarding the calculation of loss under the policy. Nevertheless, Euclid’s claims team was able to move from receipt of a loss notification to agreement on a USD 20 million payment in just 62 days. We worked quickly and collaboratively with the client and broker to reach a resolution that was acceptable to both sides, and make payment before close of the fiscal year.

While this kind of result may not be possible under all circumstances, it demonstrates one of the benefits of buying a transactional risk policy from Euclid’s highly trained and dedicated team, backed by its highly creditworthy insurance carrier partners.

A Busy Start to 2023

We have had a strong start to 2023 and have already settled 9 claims, including one where we confirmed coverage in 8 days. As we look ahead to the rest of 2023, we are excited to continue to partner with our excellent clients and brokers as we develop the transactional insurance market together.