The following is a LinkedIn Article written by Jay Rittberg, Managing Principal at Euclid Transactional.

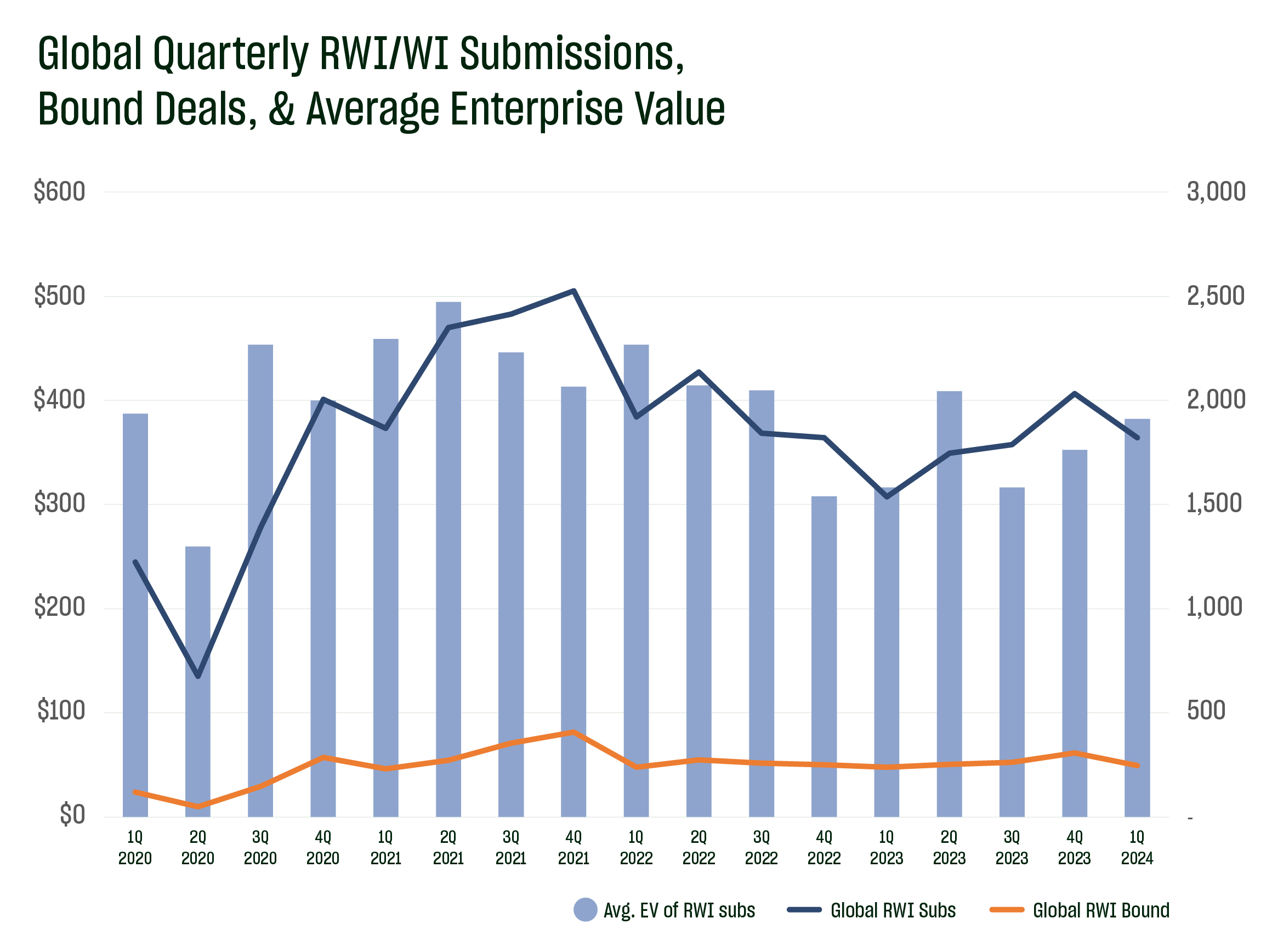

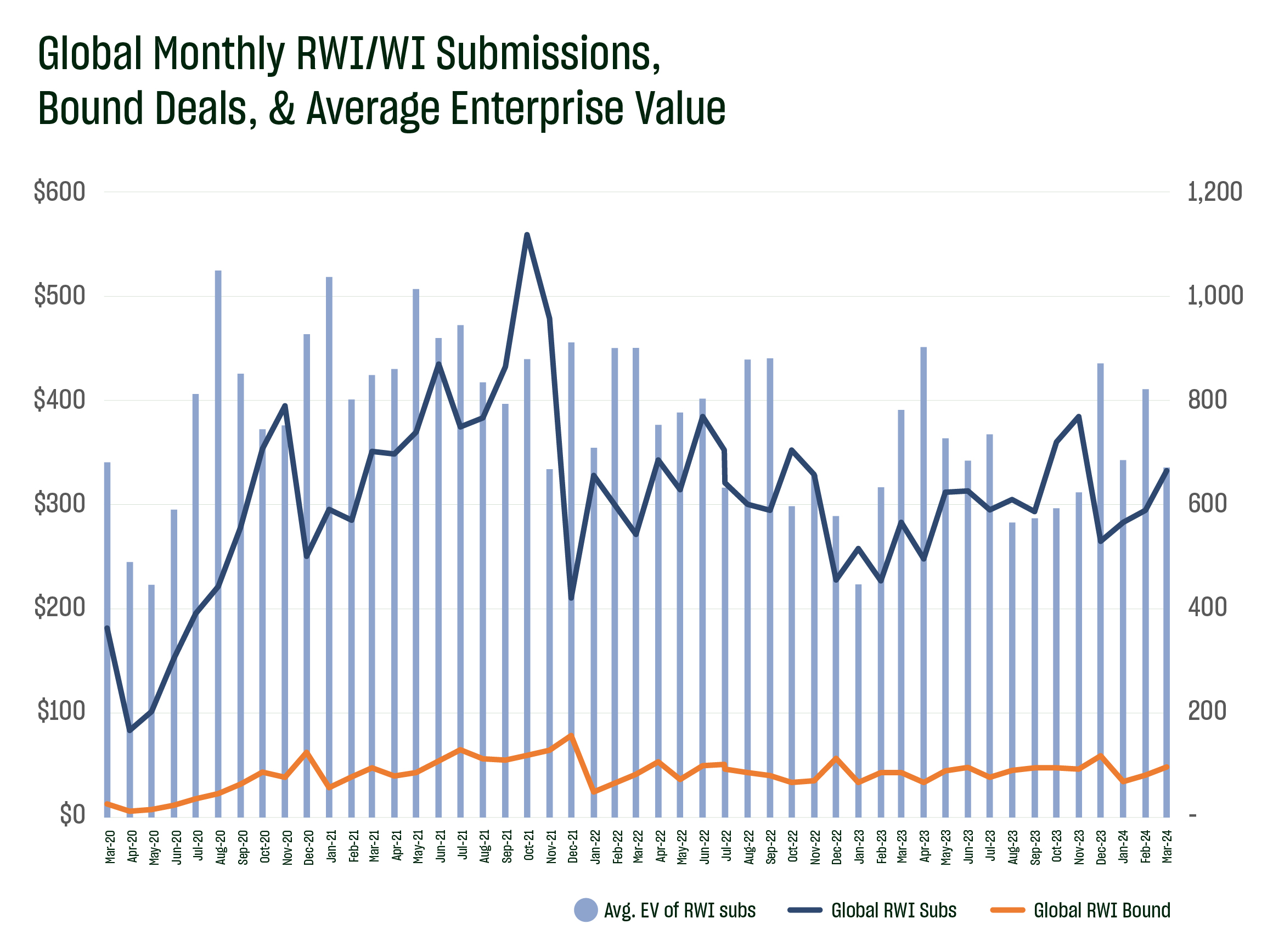

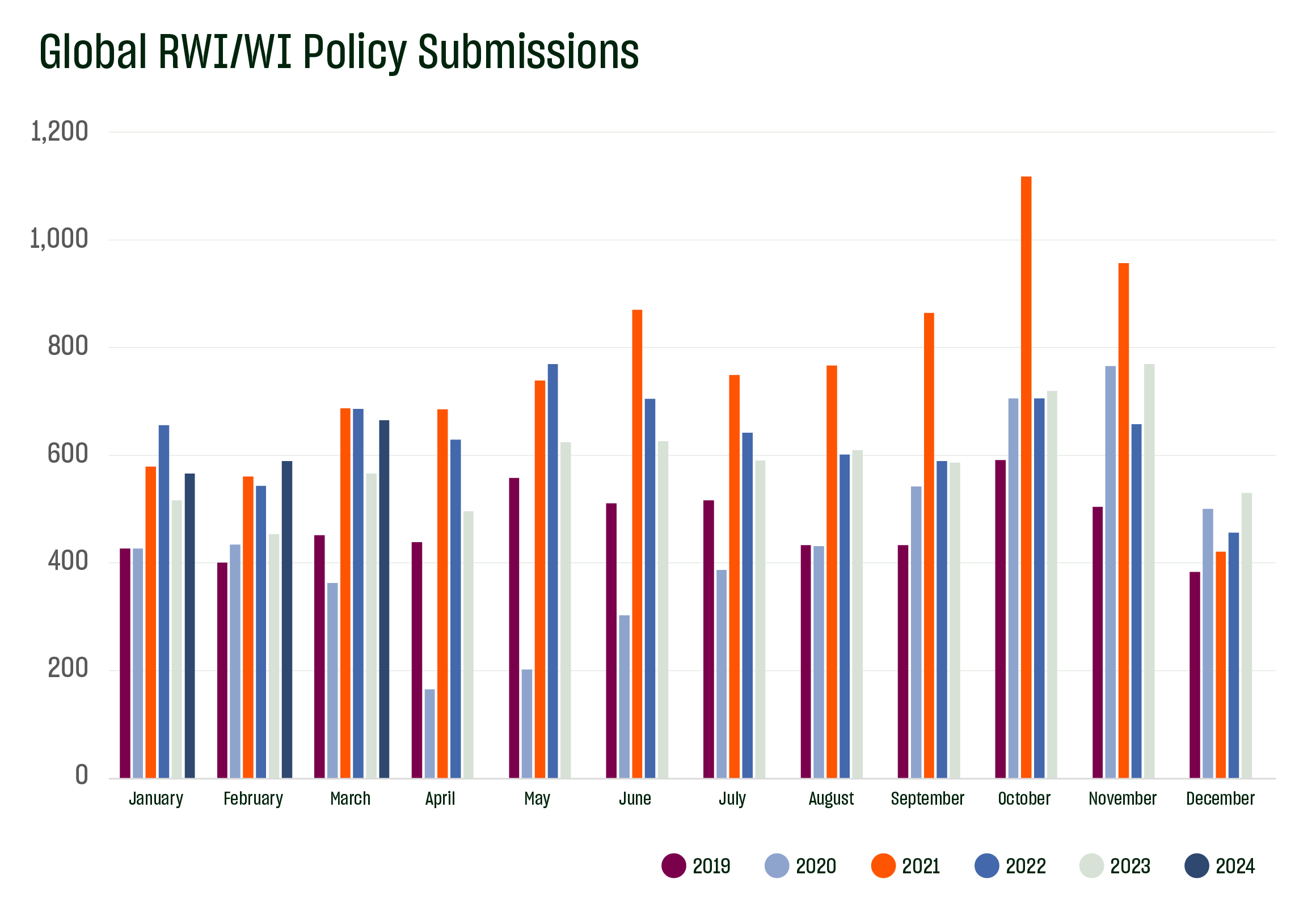

In Q1 2024, Euclid bound a Q1 record high 247 representation and warranty/warranty and indemnity insurance (RWI) policies globally, 4% more than the prior record for any Q1. We received 1820 submissions globally in Q1, up 18% compared to Q1 2023, and believe the M&A markets have some solid momentum going into Q2. Deal sizes rose for the second consecutive quarter in Q1 to over $382 million, and were just 16% below the record quarterly average enterprise values of Q1 2021. This is consistent with data relating to the return of larger deals discussed in our prior post. These numbers continue to be in line with expectations that inflation will remain steady or drop in 2024 and financing for larger deals is starting to become more available.

Despite decent deal volume and an increase in larger sized deals, we see significant pressure on primary RWI policy rates as we end Q1 and start Q2. The transactional insurance industry has now paid billions of dollars of claims (with Euclid alone having paid nearly $800 million in claims), yet aggregate rate on our primary RWI in North America are near historic lows. It is unclear if our prediction for a rise in rates in 2024 will occur, even with expected increased M&A activity and the importance of rate in supporting claims payments across the industry. This rate increase seems necessary given some of the trends identified in our Global RWI Claims Study released in Q4 and it will continue to require significant underwriting and claims-handling resources to properly support the high level of service that Euclid hopes to deliver to its partners in the M&A ecosystem.

How did your Q1 finish up? Do our numbers align with your experiences in the M&A and RWI insurance markets? What are your deal expectations for the remainder of 2024? Feel free reach out to Euclid Transactional to discuss these or any other topics.