The following is a LinkedIn Article written by Jay Rittberg, Managing Principal at Euclid Transactional.

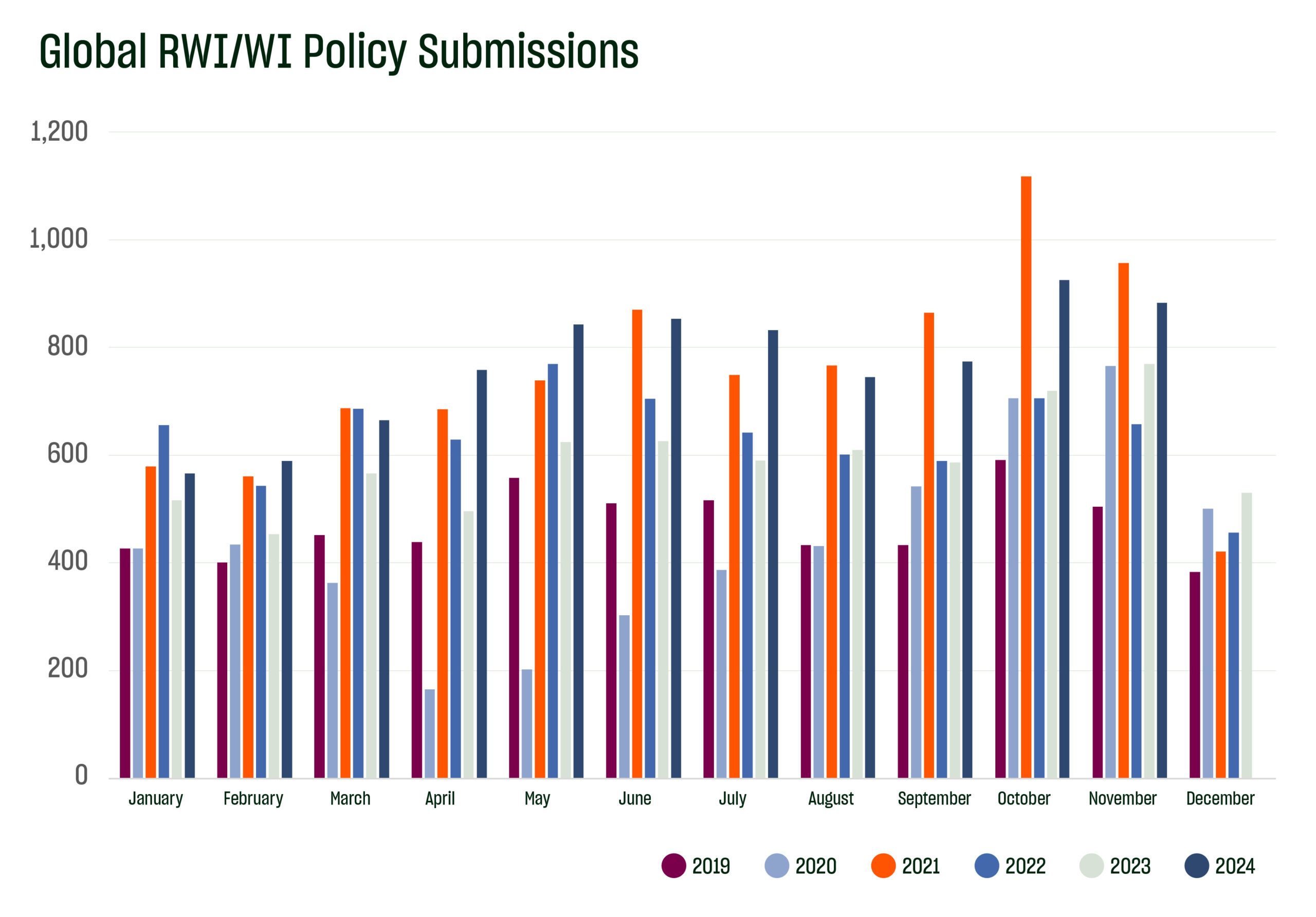

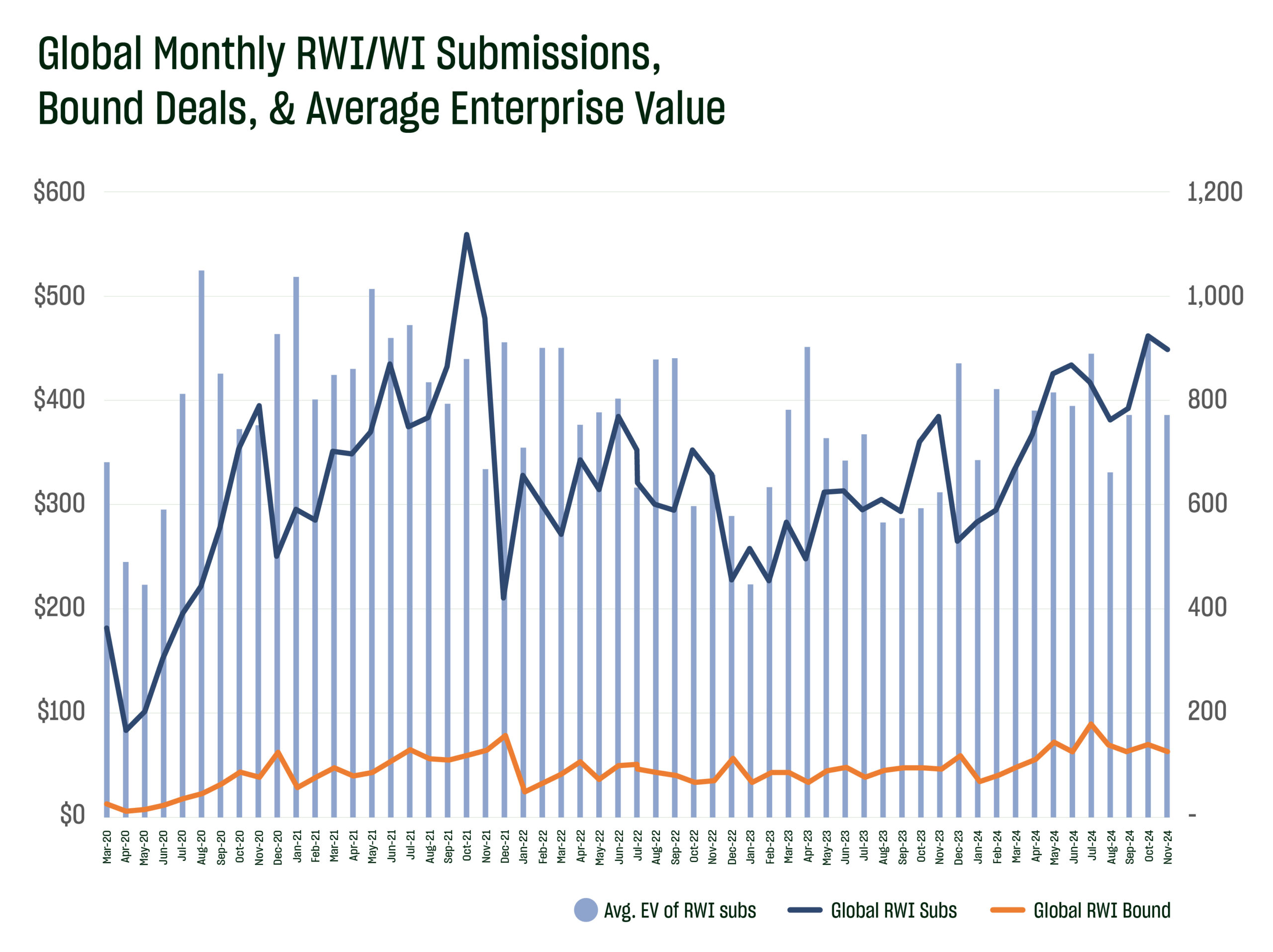

‘Twas the night before Christmas, when all through the house, not a creature was stirring, except for a slew of M&A deal makers! M&A continued on a strong trajectory in November 2024. Encouragingly, Euclid’s November aggregate premium rate on line for bound North America primary RWI policies reached their highest monthly pricing for 2024 and highest since mid-2023. Euclid Transactional received 889 representation and warranty/warranty and indemnity insurance (RWI) submissions globally in November, our second highest monthly total since November 2021 (with October 2024 representing the highest monthly total since November 2021 as noted in our prior post). With the month of December not yet finished, we have already received 19% more RWI submissions in 2024 (8,420) than in the slower M&A market of 2023 (7,088) and 10% more than in 2022 (7,640). Robust M&A activity over the second half of 2024, along with recent and prior interest rate cuts and a regulatory environment that is anticipated to be more favorable to M&A, provide ample indicators of a hot M&A market for 2025.

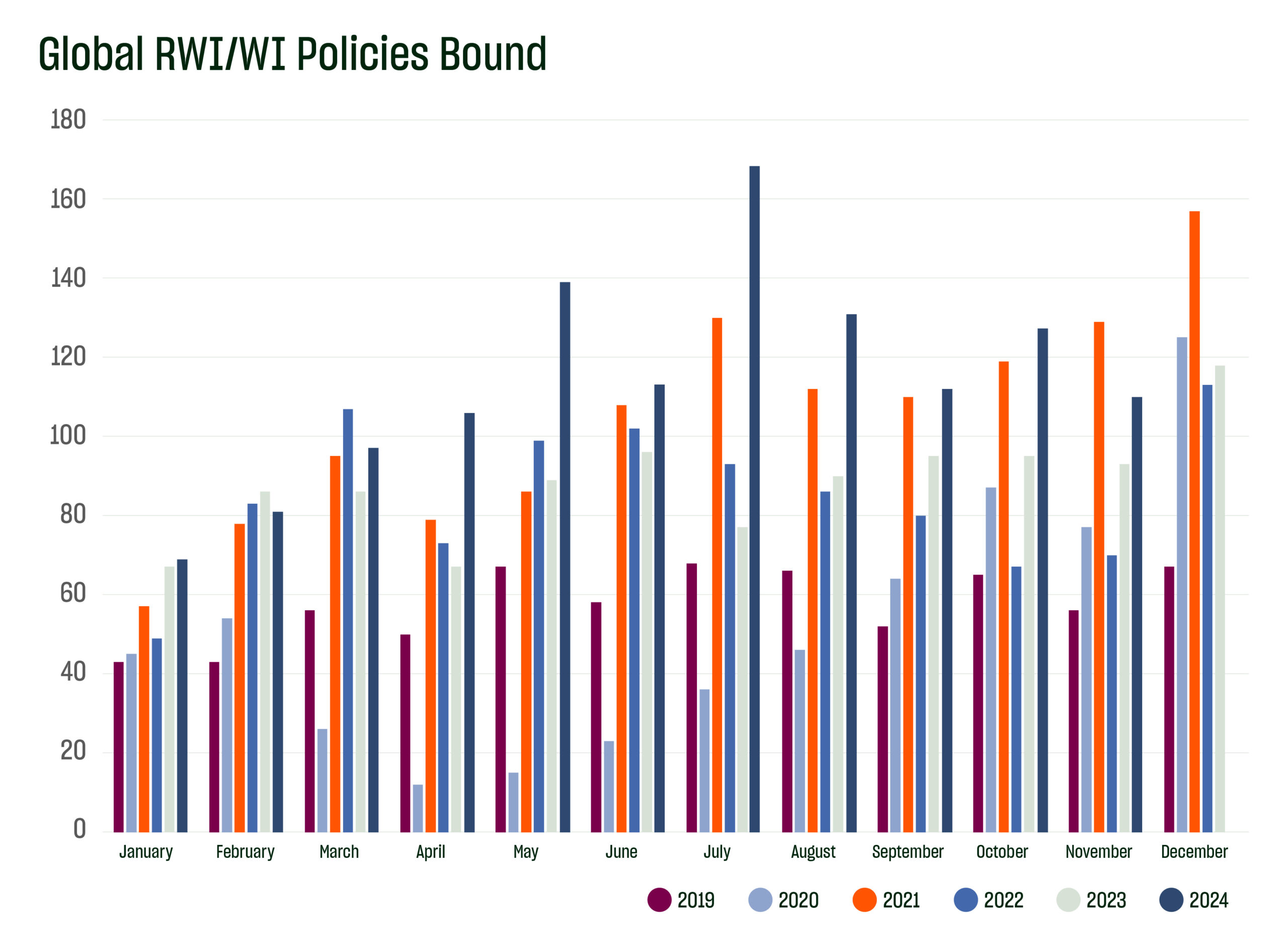

We bound 109 RWI policies globally in the holiday-shortened month of November, down from 127 in October but representing our second most bound deals in any month of November in our history (second to November 2021). The average enterprise value of submissions in November was $380M, down from $458M in October (which represented the highest average enterprise value of submissions on a monthly basis since the summer 2021). With under two weeks left to close out the year, the average enterprise value of submissions on a quarterly basis for Q2 2024 ($445M) is currently the highest quarterly value we’ve seen since Q1 2022.

Given the claims severity and large loss data underlying our 2024 Global RWI Claims Study and as further highlighted in our recent claims update, RWI rates will need to meaningfully increase over the historic lows seen earlier in 2024 in order for the industry to continue to sustainably support clients with the claims service we believe they deserve. The transactional insurance industry has now paid billions of dollars in claims, with Euclid alone having paid nearly $960 million in claims since inception and within striking distance of hitting $1B in total claims payments by end of this year. Even with the increase in Euclid Transactional’s aggregate premium rate on line for bound North America primary RWI policies, industry rates overall remain well below what most experts believe to be profitable and sustainable. Going into 2025, Euclid will remain focused on the need for rate increases while continuing to offer the highest level of service in underwriting execution and claims handling to its partners in the M&A ecosystem.

Do our numbers align with your experiences in the M&A and RWI markets? What are your expectations for M&A in 2025? Feel free reach out to Euclid Transactional to discuss these or any other topics.

Happy holidays!!