The following is a LinkedIn Article written by Jay Rittberg, Managing Principal at Euclid Transactional.

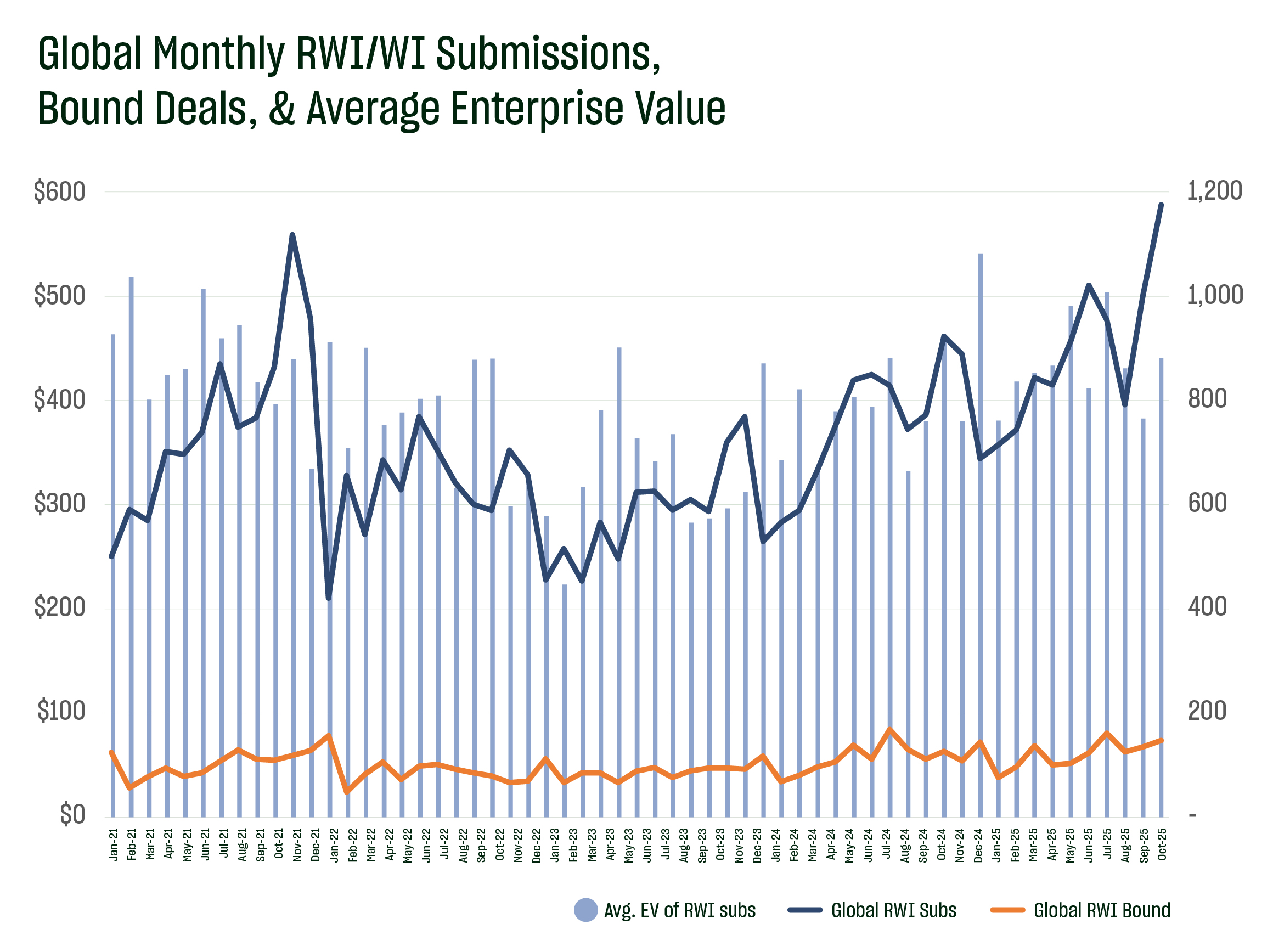

October 2025 representation and warranty/warranty and indemnity insurance (RWI) data reflected a record-breaking month for global RWI submissions, evidencing an increasingly strong M&A market. Average enterprise values for global RWI submissions in October surpassed September enterprise values, and we expect to bind more larger deals to finish off the year.

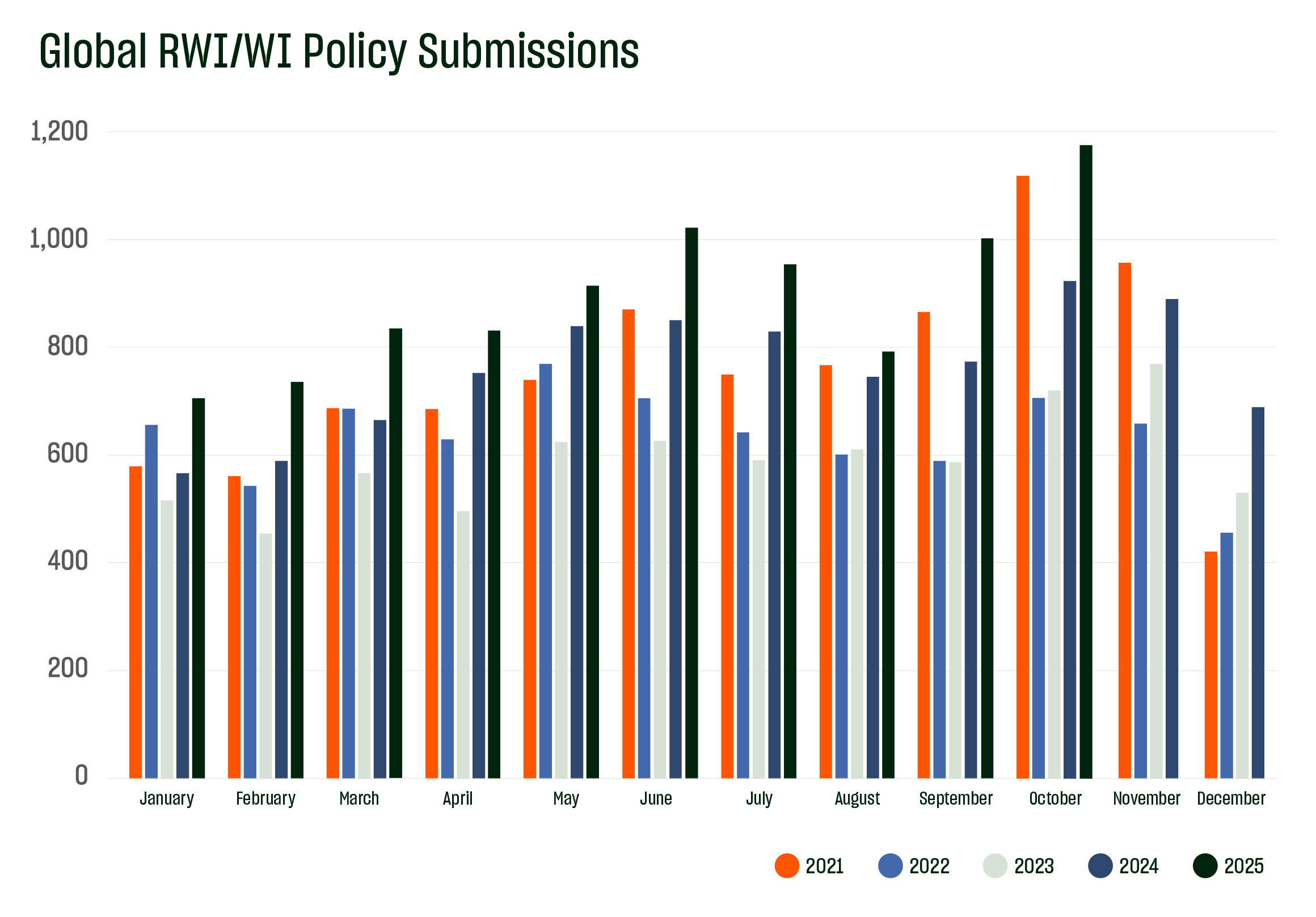

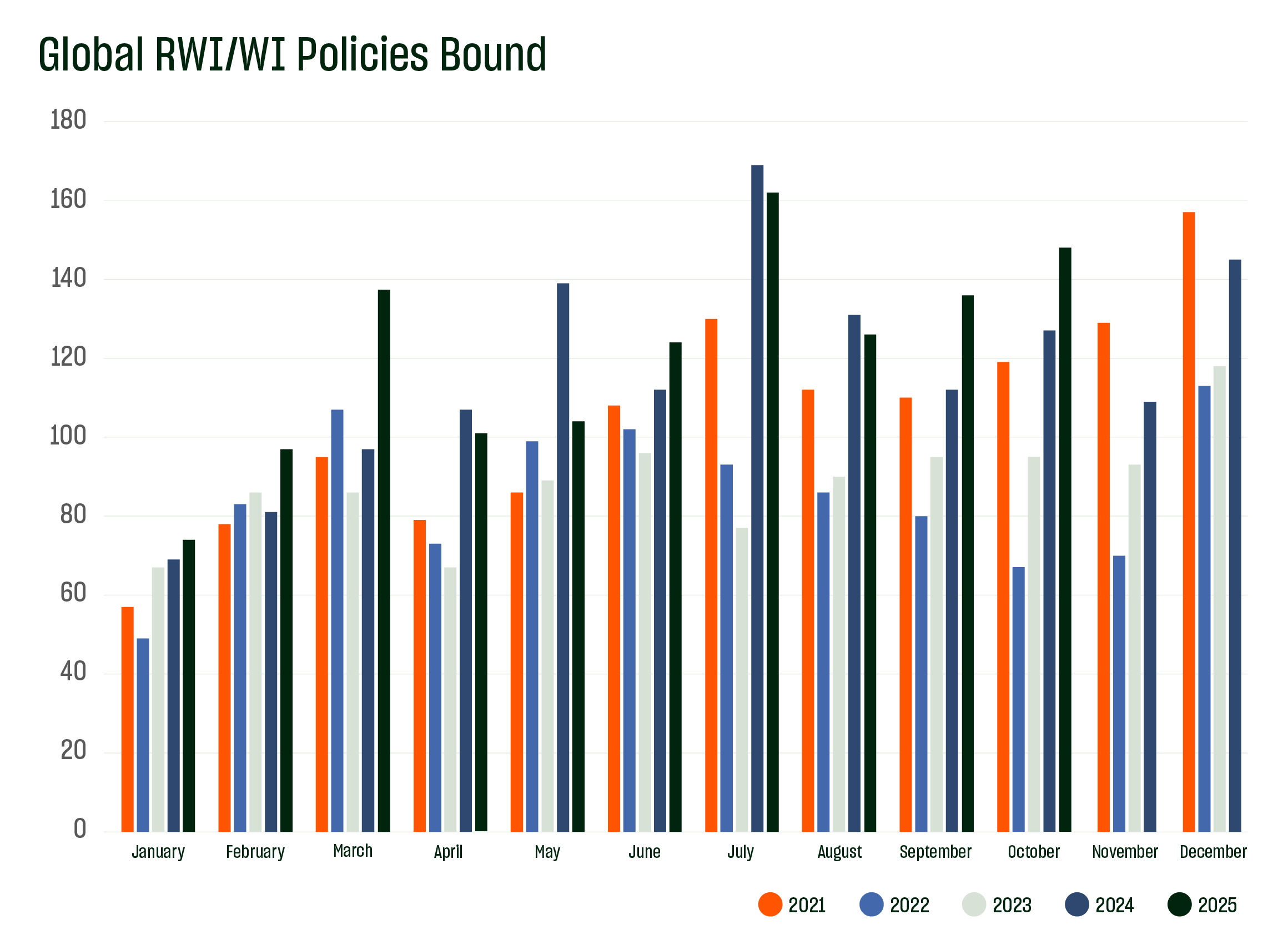

Euclid Transactional received 1,175 global RWI submissions in October, which is the highest monthly level we have seen in our nine-year history, and reflects a 17% increase over what we saw in September. Similarly, the average enterprise value of global RWI submissions in October was $440.71M, which reflects a 15% increase over September’s data, and a slight increase from the $430.77M average we saw in August. Euclid also bound 148 global RWI policies in October, which is second only to July for most monthly policies bound in 2025 and reflects a 9% month to month increase over September.

Euclid Transactional remains focused on increasing and maintaining sustainable RWI rates on line to continue to deliver the exceptional underwriting service and fair and efficient claims process for which we are known. We proudly announced earlier this year that we eclipsed $1 billion in RWI claims paid in less than 9 years of operation, including $300 million in RWI claims paid in 2024 alone. While aggregate premium rates have been rising in 2025, industry average rates seem to remain below the levels most industry experts consider profitable and sustainable. Our 2024 Global RWI Claims Study highlights the increasing severity of loss payments, underscoring the need for meaningful and lasting upward rate movement.

Do our numbers align with your experiences in the M&A and RWI markets? What are your expectations for M&A in December and into 2026? Feel free reach out to Euclid Transactional to discuss these or any other topics.