The outlook for the M&A market appears murky for the second half of 2022, but the same cannot be said for RWI/W&I insurance claims. After record-breaking M&A volume from the end of 2020 through 2021, there are more RWI/W&I policies outstanding today than at any other time in the industry’s history. Globally, Euclid Transactional underwrote over 1,300 bound in 2021 alone, an increase of 110% over 2020. The logical result of this increase in underwriting volume is a lagging increase in claims volume, and a wave of new claims has already started rolling into our inboxes. During the first half of 2022, we saw a 39% increase in total claim notices as compared to the same period for 2021. Choosing a partner that has adequate resources and staffing is critical to a smooth claim process. We recently added several new members to our global claims team to keep pace with this increasing volume. In this post, we highlight some statistics surrounding claim frequency data, claims timing and introduce new claims team members, Justin Giles, Arielle Nagel and Layla Sousou.

Claim frequency for our program averages 19%, which means that, of the 1,300 policies we bound in 2021, we would expect to receive approximately 250 claims.

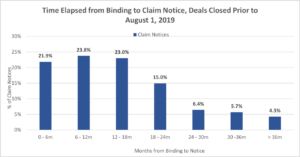

RWI/W&I claims lag the binding of a policy, because it normally takes buyers some time to discover historical issues at companies they have acquired. For our policies that have been bound for at least three years, the average length of time that elapses from the binding of a deal to the receipt of a claim notice is 448 days, with 84% of claims being made within 24 months (see the chart above).

That puts us currently in the bullseye for the last of the claims on policies bound at the busy end of 2020 and the beginning of 2021, with claims relating to the massive end of 2021 and beginning of 2022 starting to roll in as well. During the first half of 2022, we received over 100 claim notices, with 93 of those notices related to 2020 and 2021 policies. As mentioned previously, this represented a 39% increase over the first half of 2021. We expect the pace to increase through the end of this year and into 2023.

To keep pace with the anticipated claims volume, we have continued to grow our industry-leading claims team to ensure efficiency and responsiveness. Justin Giles previously worked as a litigation associate for Quinn Emanuel Urquhart & Sullivan. Arielle Nagel previously worked as a litigation associate at Latham & Watkins. They each join us with titles of Associate General Counsel and Vice President, Claims. Layla Sousou previously worked as an attorney at a specialized litigation boutique firm in London and joins us as Vice President and Claims Counsel in our London office. We are pleased to welcome them to our claims team, which now boasts 17 claims professionals ready to service claims on your most important deals.