The following is a LinkedIn Article written by Justin Berutich, Managing Director and Head of Tax at Euclid Transactional.

Euclid Transactional’s tax team entered 2025 with high expectations for increased volume and Q1 did not disappoint. The first quarter has been defined by strong demand, deepening market engagement, and robust deal flow. If these early months are any indication, tax insurance is poised for another banner year.

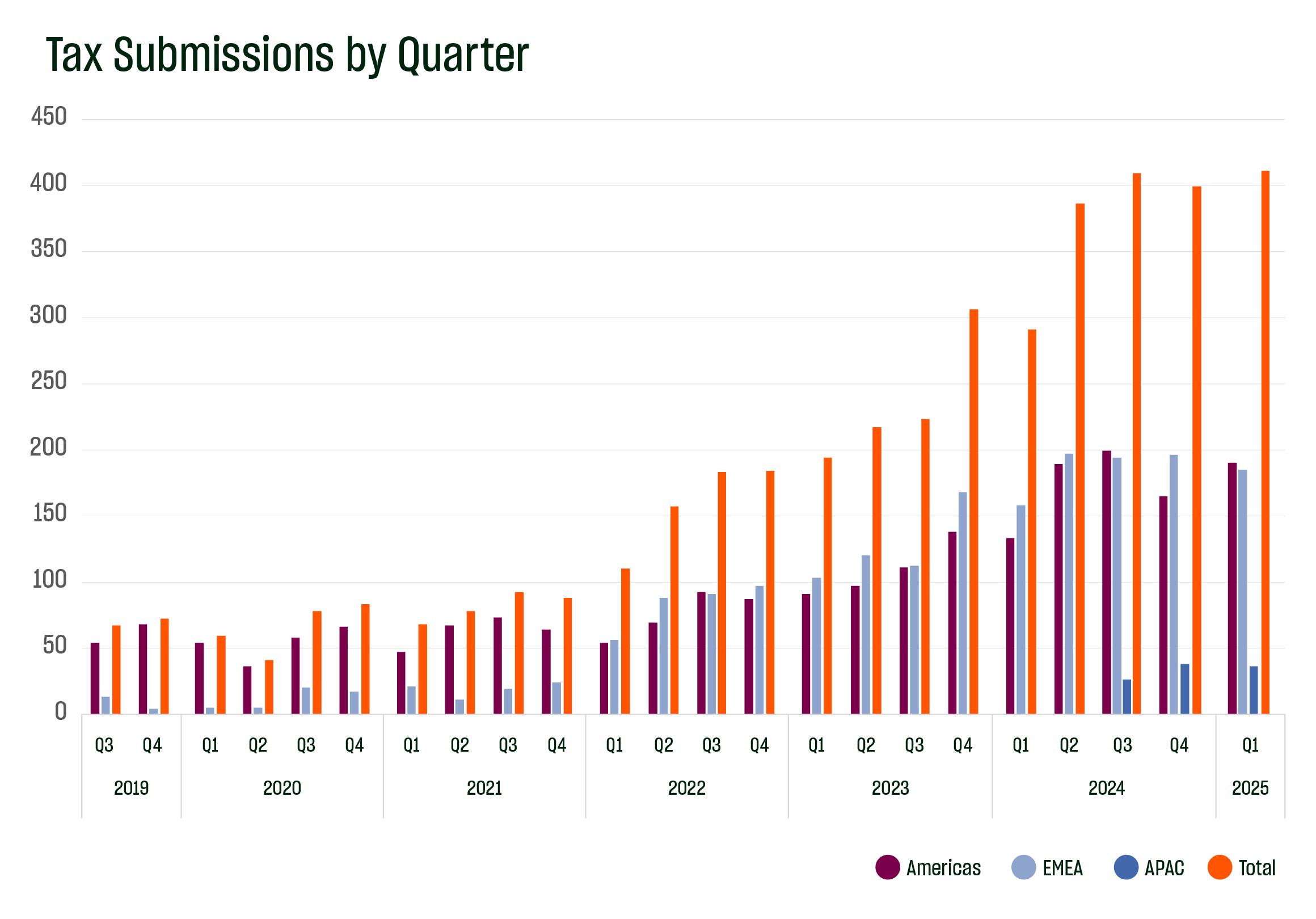

Euclid received a record 412 tax submissions globally in Q1 2025, surpassing the previous Q1 record by over 40%. North America and EMEA saw 191 and 185 submissions reflecting year-over-year growth of 42% and ~18%, respectively. Meanwhile, our APAC team, which launched in Q3 2024, fielded 36 tax submissions in its first Q1, signaling strong regional momentum.

Renewable energy remains a significant growth driver in North America, with more than 60% of tax submissions stemming from this sector. While M&A headlines often highlight market uncertainty, we continue to see consistent demand for tax insurance related to M&A transactions.

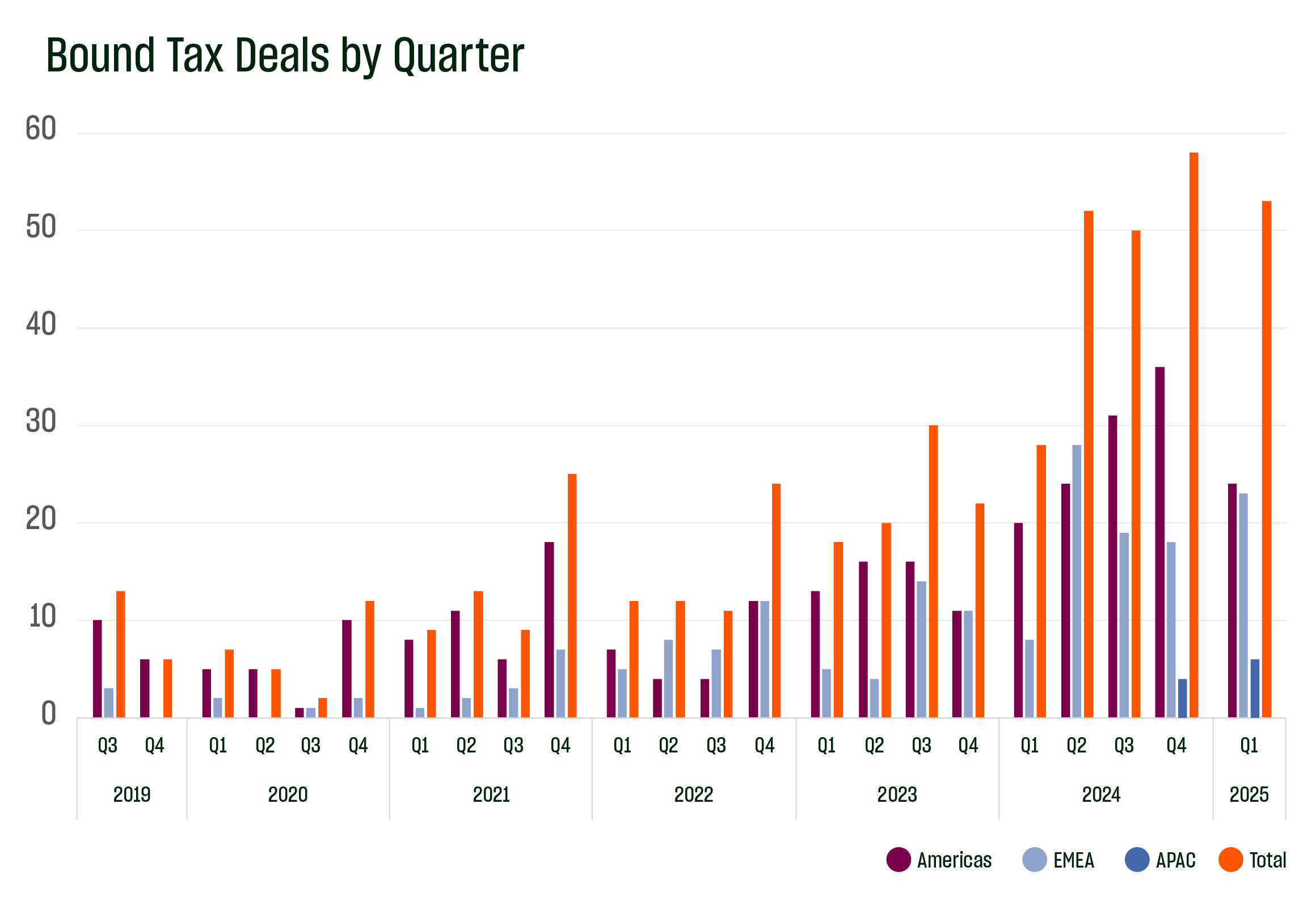

We believe execution remains a differentiator. Our 14-person tax team, with decades of collective experience, is adept at navigating complex risks under tight timelines. This expertise has converted record submissions into bound policies, with 53 policies bound in Q1 2025 – an increase of over 95% year-over-year. North America’s bound tax policy count rose by more than 25%, while EMEA posted an impressive 185% increase. Since issuing our first tax policy in 2018, Euclid’s global tax team has placed over $13.87 billion in policy limits.

Looking ahead, we are closely monitoring developments in Washington, D.C., including the “Super Bowl of Tax” and shifting geopolitical dynamics. While these events may shape tax policy, they reinforce the need for strategic risk mitigation, something tax insurance is well-positioned to provide.

Do these trends align with what you’re seeing in the market? Connect with Euclid Transactional to discuss.