Despite the horrible challenges created by the war in Ukraine and some uncertainty in the world of M&A, our 2022 first quarter results demonstrate a strong start to 2022 with submissions and policies bound exceeding 2021’s first quarter.

A Look at Our Numbers

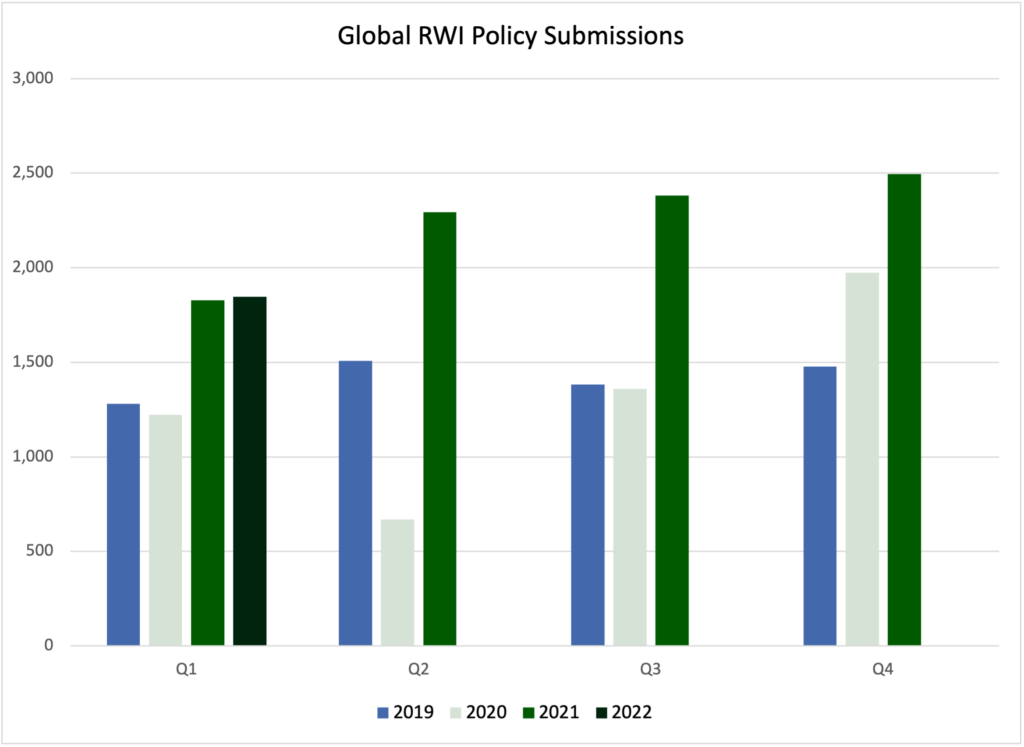

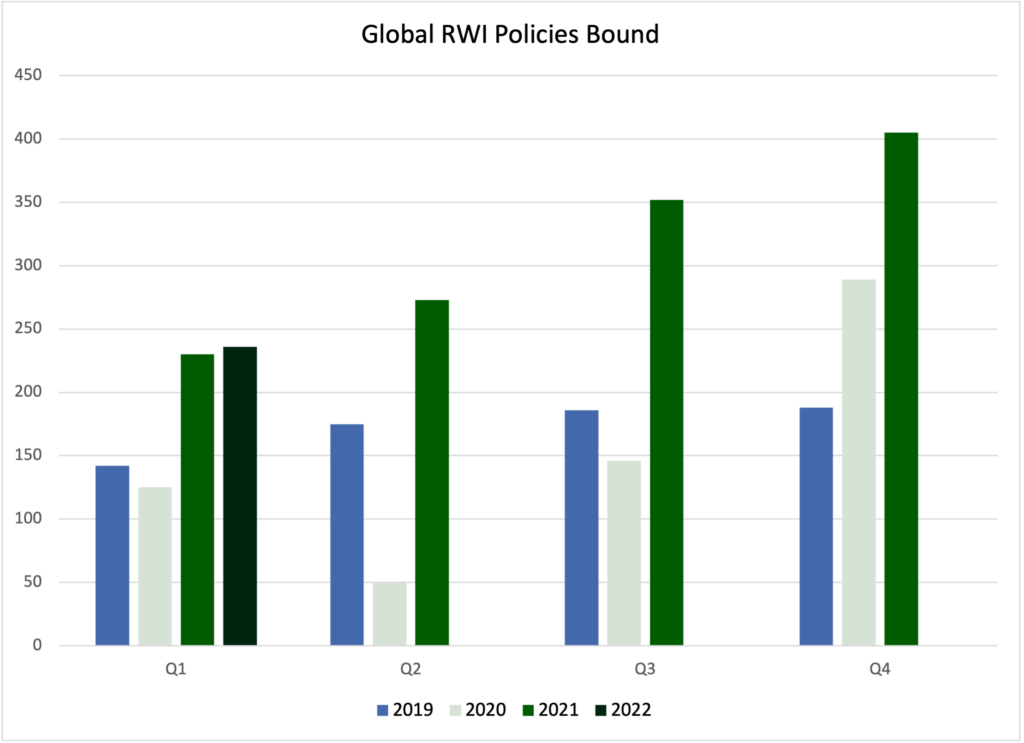

While total submissions increased for the entire first quarter of 2022 relative to the first quarter of 2021, submissions trended downward toward the end of this quarter and have recently fallen behind last year’s pace. We believe submission volume may be impacted by interest rate related financing concerns and ongoing geopolitical instability, but believe there will be a rebound as clients look to deploy the substantial capital at their disposal before the end of the fiscal year. See below for Euclid’s global policy submissions and deals bound by quarter for the last four year period.

Our Perspective Updates

Excess Representations and Warranties Insurance: Not Risk Free!

Deal sizes are continuing to grow, and excess policies are becoming more necessary to secure sufficient limits on M&A transactions. Excess policies, however, are not risk free. Our team has paid almost $50M in excess claims, and we estimate that over 50% of the deals we underwrote in 2021 had an excess policy.

Euclid Transactional Opens Copenhagen Office

Euclid Transactional has opened a new Copenhagen office which will be led by Vice President, Daniel Boda. The new office will further expand the firm’s capabilities in the Nordic region and build on its substantial expertise across the United Kingdom (UK), continental Europe, and the Middle East and Africa (EMEA).

Euclid Transactional Adds Hudson Insurance Group and Westfield Insurance to its M&A Insurance Program in North America and Expands Partnership with Zurich North America

We are excited to announce that Hudson Insurance Group and Westfield Insurance will now be participating in our North American program and our existing partner Zurich North America has agreed to increase its committed capacity. The new and expanded insurance carrier support will raise Euclid’s maximum per-deal underwriting limit of liability to $90 million on U.S. R&W transactions, $79 million for Canadian R&W transactions and $81 million for tax transactions.

Thriving in Uncertain Times

Amidst this uncertain economic environment, M&A managed to post an unprecedented level of deal activity in 2021. In 2022, we expect several external factors to influence the market. Concerns about the Fed’s inflation-fighting plans, tensions over Ukraine, and kinks in the supply chain all bear watching. Uncertainty is a constant, and the market often can find a way to thrive in spite of it, as 2021 demonstrated.

Spotlight on Tax Insurance Manager Justin Berutich

Managing Director and Head of Tax, Justin Berutich, is featured in Bloomberg’s Tax and Accounting Spotlight. In it, Kelly Phillips Erb and Justin discuss Justin’s background, favorite activities, and impactful tax news.

Want to stay in the loop? Sign up for our newsletter below to receive Quarterly Updates directly to your inbox.