The following is a LinkedIn Article written by Justin Berutich, Managing Director and Head of Tax at Euclid Transactional.

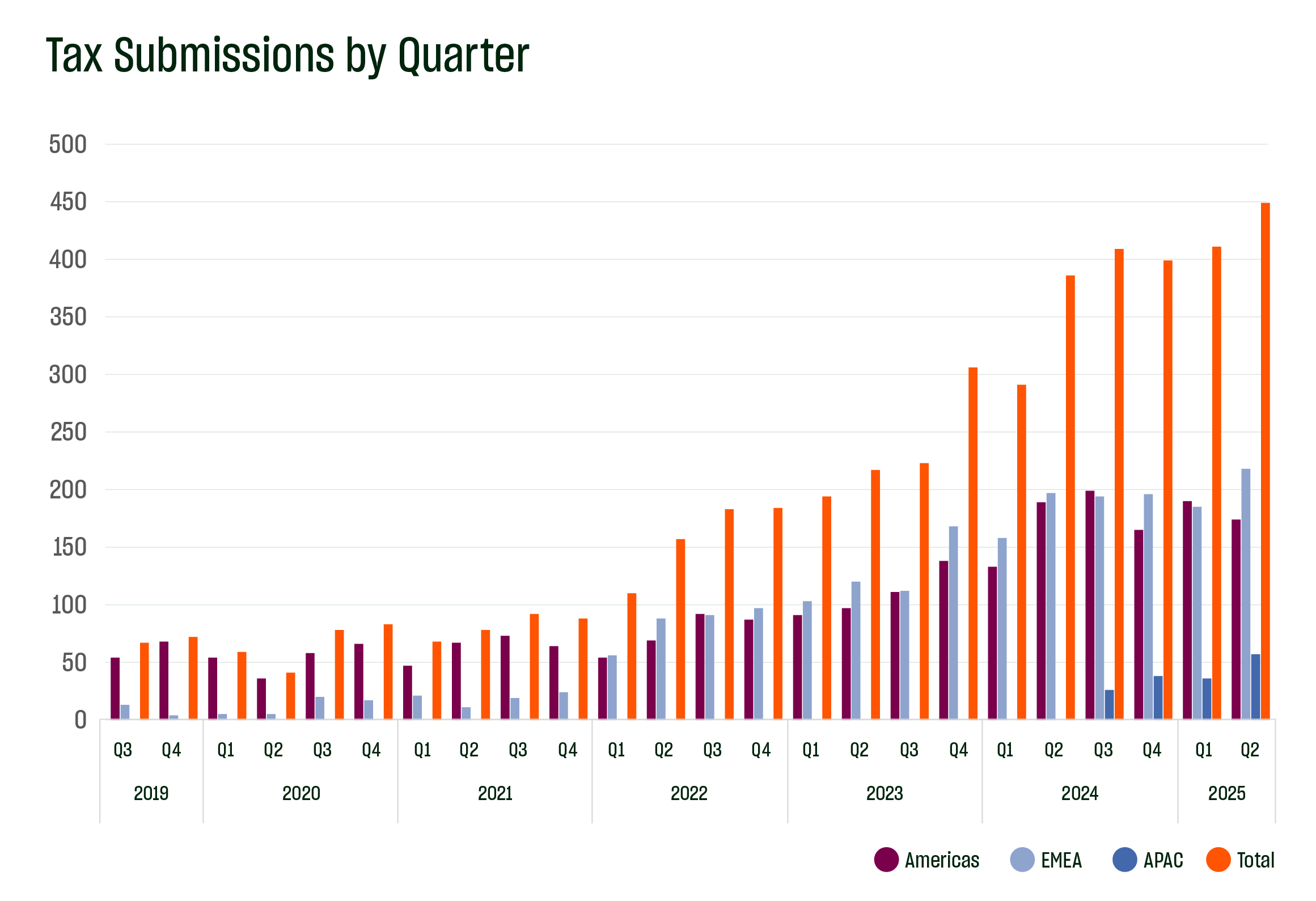

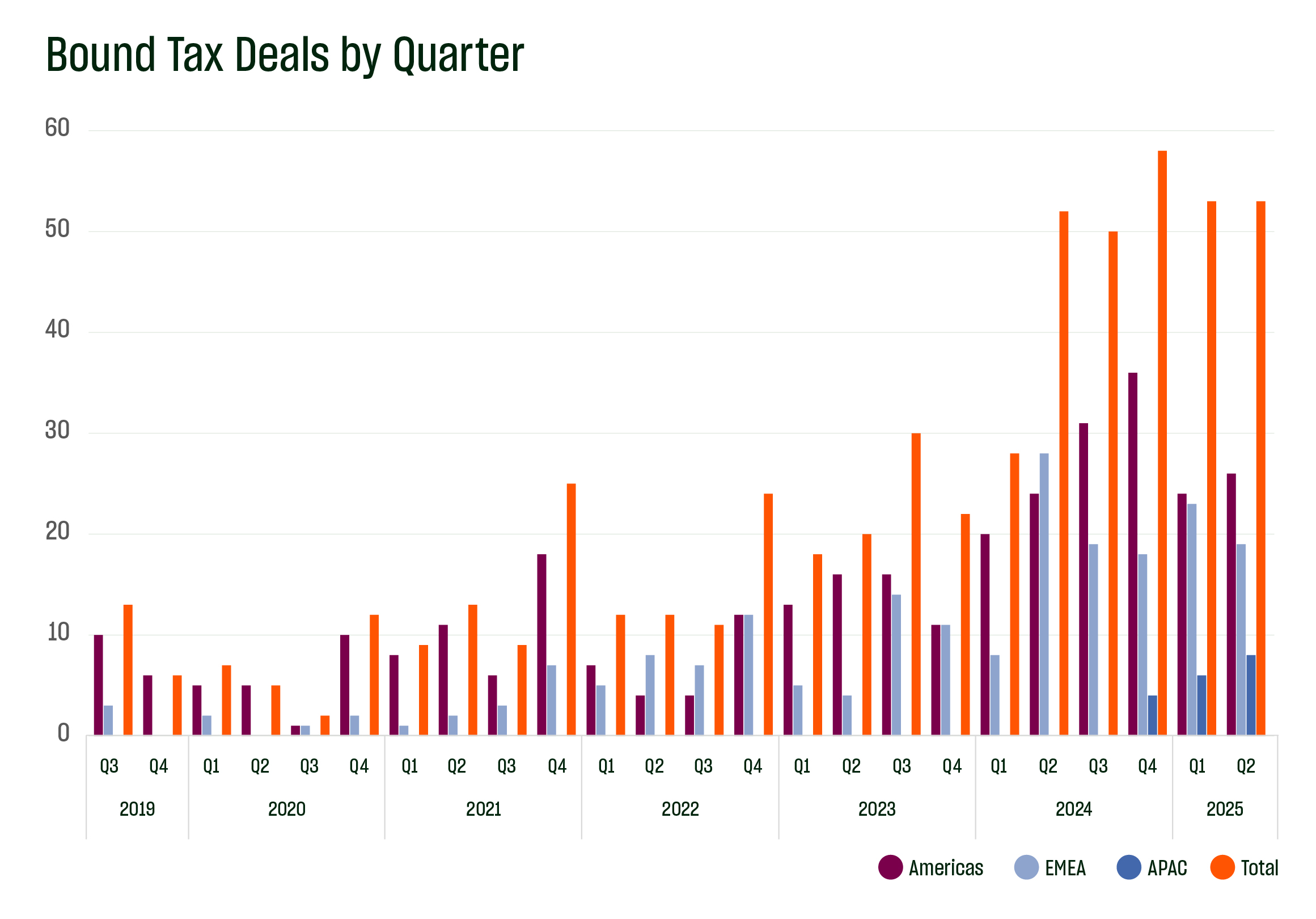

Uncertainty defined Q2, fueled largely by pending tax legislation and renewed global trade tensions. Yet, amid the noise, one thing is clear – the demand for tax insurance continues to grow. Euclid Transactional’s tax team witnessed this firsthand. Global tax submissions are up ~20% compared to this time last year, with binds climbing 34% during this same period. In uncertain economic times, taxpayers can rely on tax insurance to help provide tax certainty.

In North America, reduced M&A activity in Q2 contributed to a ~10% decline in submissions compared to Q2 2024, with 174 opportunities received in Q2 2025 versus 193 the prior year. Still, 1H25 remains ~10% ahead of last year’s record-setting pace (363 vs. 328). In EMEA, where M&A momentum remained strong, our team recorded ~5% quarter-over-quarter growth (217 vs. 206) and ~9% growth compared to the first half of 2024 (397 vs. 364). APAC is off to a strong start in 2025 as well, with 53 submissions in Q2 and 90 across the first half of the year.

Globally, tax insurance binds in 1H25 are up nearly 35% over the first half of 2024. Euclid bound 106 policies – 50 in North America, 42 in EMEA, and 14 in APAC. As we enter the back half of the year – historically our busiest period – we do so with a robust pipeline, positioning us for a strong 2025 finish.

We do not anticipate any material near-term issues with the passage of the One Big Beautiful Bill Act. In fact, we believe it may accelerate renewable energy activity, as sponsors, investors, and credit purchasers move to insure compliance under the current rules.

To meet rising demand and uphold our commitment to an efficient and commercial underwriting process, we continue to grow our global team. We are now 18 members strong and strategically positioned across key global markets to deliver seamless service to our broker partners and clients. Since issuing our first tax policy in 2018, Euclid’s global tax team has placed over $15.5 billion in policy limits. More than $3.3 billion of that total was placed in just the first half of 2025.

Do these trends align with what you are seeing in the market? Let’s connect to explore how tax insurance can support your strategy in today’s uncertain environment.