The following is a LinkedIn Article written by Justin Berutich, Managing Director and Head of Tax at Euclid Transactional.

The bar was set high after Q2 2024, but Q3 managed to surpass it, highlighting the growing demand and impact of tax insurance across industries. The upward trajectory continues – could the best be yet to come?

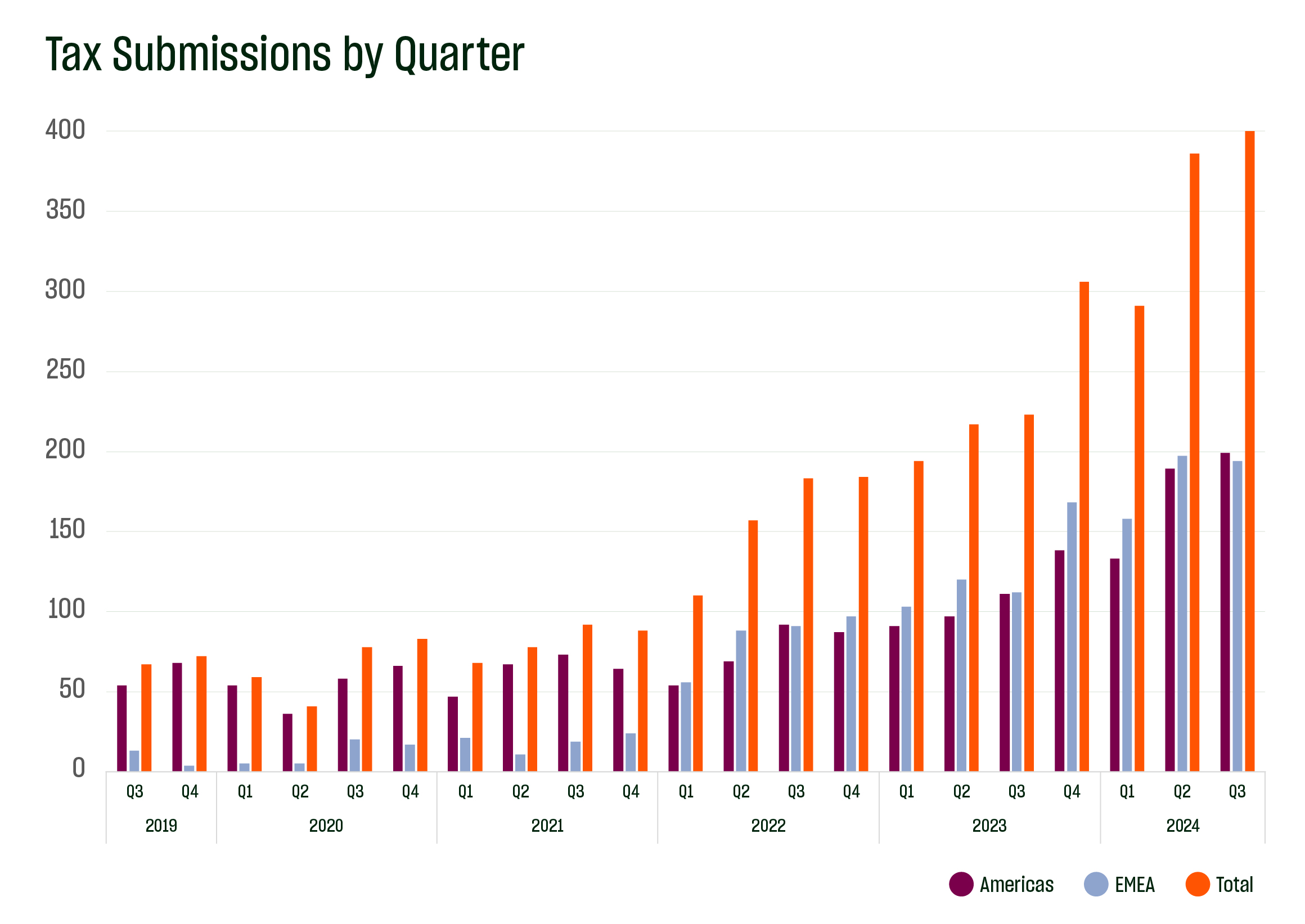

The third quarter of 2024 was Euclid’s busiest in history, with 400 global tax submissions (beating the previous record set in Q2 2024), including 199 from North America, 194 from EMEA, and 7 from APAC. This represents a 79% increase globally over Q3 2023, with growth of 79% in North America and 73% in EMEA. Year to date, we’ve received over 1,077 tax insurance submissions in 2024, surpassing the full-year 2023 total of 940 by 14%, with all of Q4 still ahead.

The September 15, 2024 U.S. federal income tax filing deadline for developers transferring 2023 tax credits under the Inflation Reduction Act played a key role in driving significant tax insurance volumes in the third quarter. As developers worked to finalize deals and ensure compliance, the demand for tax insurance surged. This wave of activity not only fueled insurance transactions but also reinforced the growing reliance on tax insurance to mitigate uncertainty and facilitate tax credit deals.

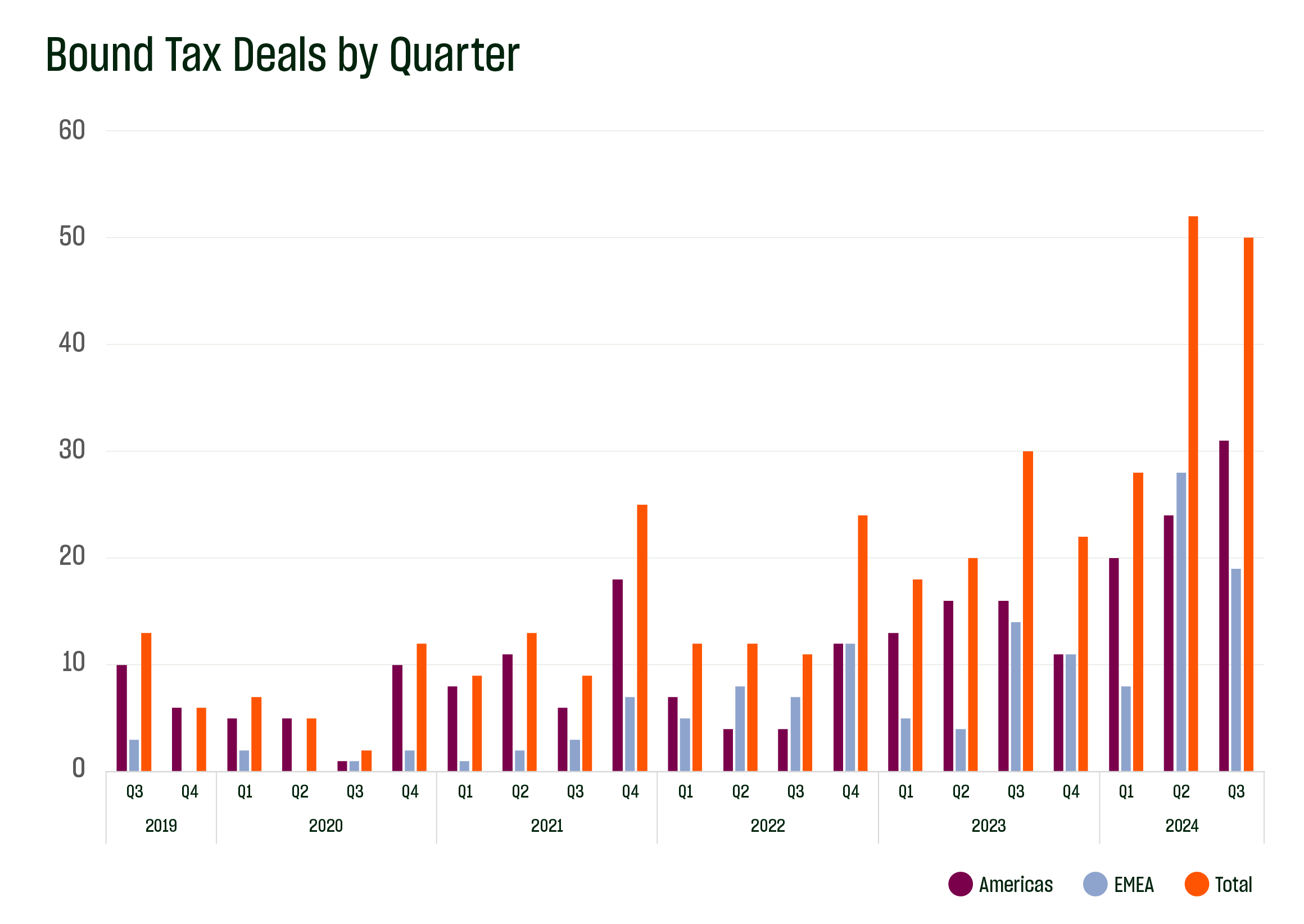

Our team’s expertise, global reach, and dedication have turned this record submission volume into record policy volumes. We consistently find that when tight timelines and execution concerns drive deal decisions, Euclid wins an outsized share of new engagements. We believe this is due to our 13-person tax team, with decades of combined experience, which excels in delivering under pressure.

As expected, the increased submission volume has translated into record-bound policies in 2024. Through the end of Q3, Euclid has issued 130 tax insurance policies – 75 in North America and 55 in EMEA. This surpasses the previous full year record of 90 policies bound in 2023 by 44%, with growth of 32% in North America and over 60% in EMEA.

The fourth quarter has historically been the busiest in the tax insurance space, and we’re optimistic this trend will continue, setting the bar even higher for the industry. With the recent launch of Euclid’s Asia Pacific offering, headquartered in Singapore, we’re now able to serve clients and broker partners across the Asia Pacific region, in addition to those in the Americas, UK, continental Europe, the Middle East, and Africa. This expanded global reach should drive continued growth in Q4 and beyond.

Clients are choosing to work with our team not only for our global reach and depth of underwriting expertise, but also because of Euclid’s industry-leading claims team. We are proud that our clients recognize the value added by our 20-person claims team, which has processed over $800 million in payments, ensuring peace of mind when a claim does arise.

The growth trajectory of the tax insurance space remains strong. Euclid Transactional’s tax team owes its success to the unwavering support of our dedicated brokers, lawyers, and client partners, who have been instrumental in our achievements.

Do our numbers align with your experiences? Reach out to Euclid Transactional to discuss these or any other topics.