The following is a LinkedIn Article written by Justin Berutich, Managing Director and Head of Tax at Euclid Transactional.

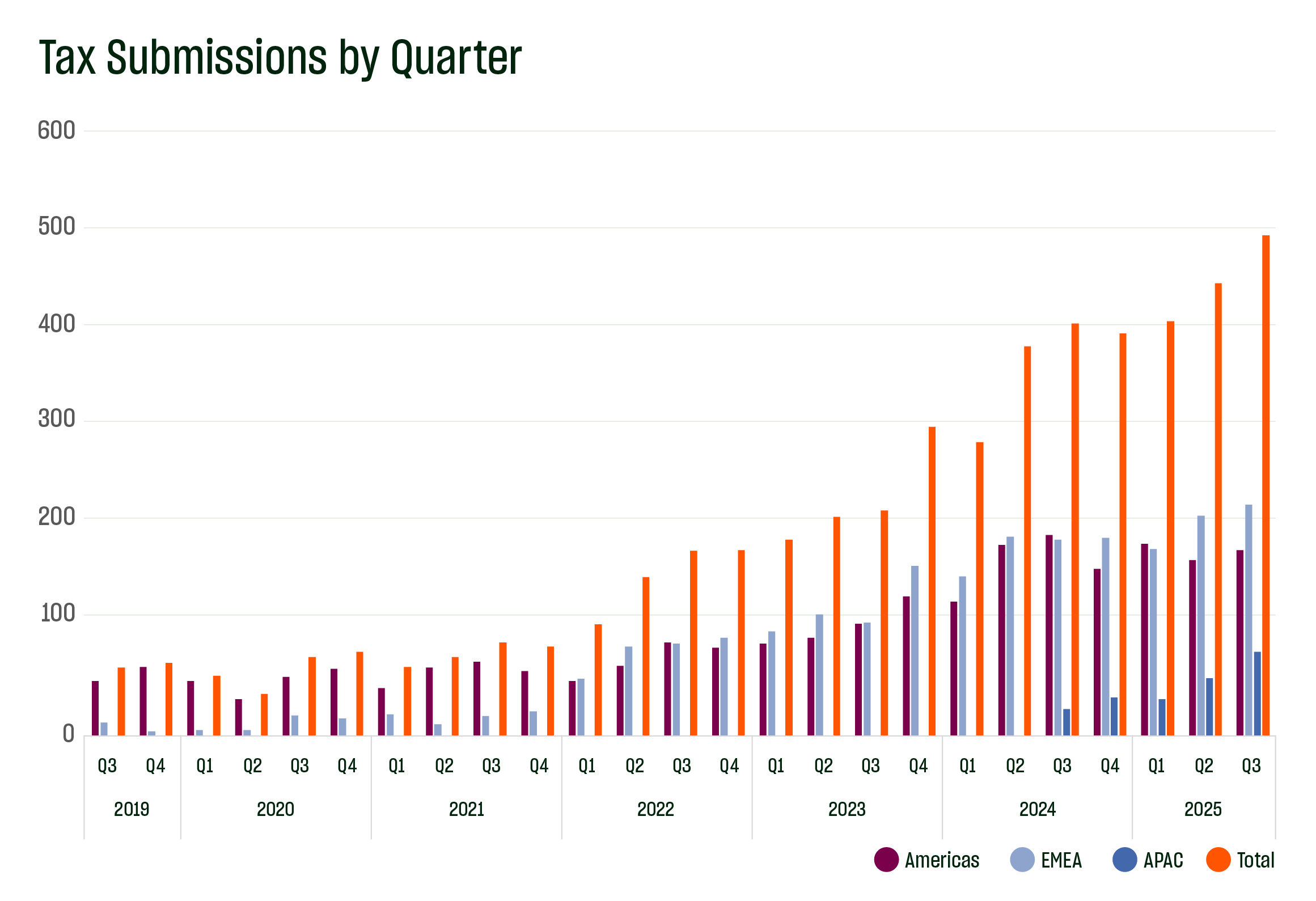

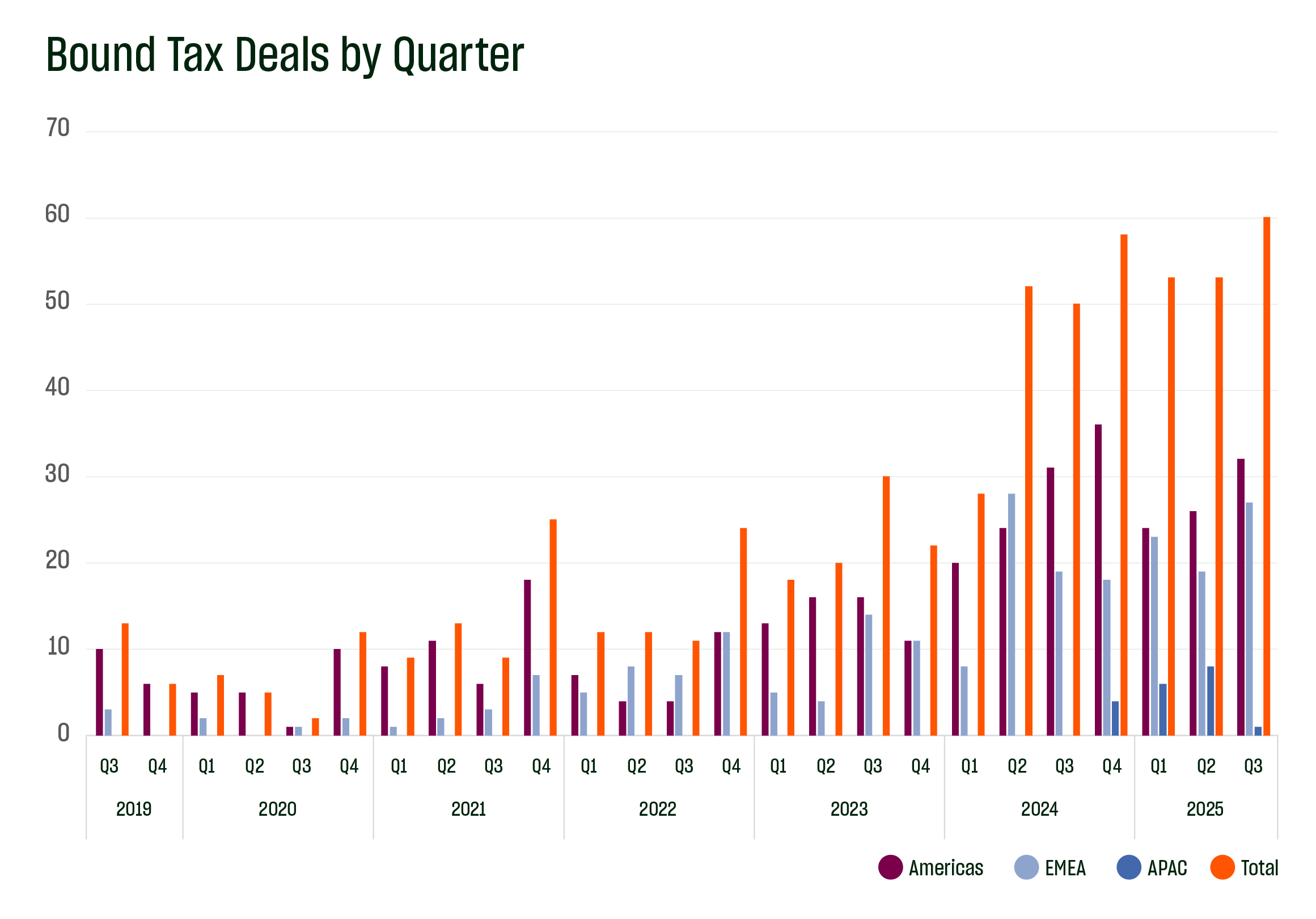

A major takeaway from the third quarter is that resilience creates opportunity. The global economy weathered headwinds and opened the door to renewed growth. That momentum translated into a record quarter for tax insurance, with global tax submissions for the year up nearly 23% and bound policies up over 30% YoY. Euclid believes this surge reflects not only heightened transactional activity but also a growing recognition of tax insurance as a strategic tool for unlocking capital and accelerating growth.

3Q25 Highlights by the Numbers

- 492 global tax submissions – 183 North America, 225 EMEA, 84 APAC – contributing to ~23% YoY growth (1,365 vs. 1,111).

- Regional submission trends – While North America and EMEA were slightly down in submissions vs. 3Q24, APAC surged, up 800% from 3Q24.

- 60 bound policies globally – setting a Q3 record, made up of 32 North America, 21 EMEA, 7 APAC. Bound policies are up over 30% YoY with North America up ~11% YoY, EMEA up ~6% YoY, and APAC up ~900% YoY.

These results underscore the critical role of tax insurance in mitigating uncertainty and enabling transactions in an increasingly complex global market.

As anticipated, we have not experienced any material near-term issues following the passage of the One Big Beautiful Bill Act. In fact, renewable energy activity remains robust as sponsors, investors, and credit purchasers look to gain greater certainty via tax insurance.

In today’s interconnected economy, challenges and opportunities rarely stop at national borders. That is why Euclid believes working with a truly global team matters. Euclid strives to bring together expertise across regions and time zones to navigate local nuances and coordinate complex, cross‑border solutions, ensuring clients benefit from a unified approach that matches the global nature of their business.

Entering the fourth quarter – historically the busiest – with a robust pipeline, positions our team for what we anticipate will be a strong 2025 finish.

Do these trends align with what you are seeing in the market? If you’re evaluating a tax position, our global team is ready to explore how tax insurance can support your strategy in today’s uncertain environment.