The following interview is from a Schulte Roth & Zabel LLP Alumni Spotlight featuring Managing Principal Jay Rittberg.

This Q&A with Jay Rittberg offers insights into his career journey, beginning with his role in Schulte’s Corporate department, where he developed key skills in finance and M&A. Jay highlights the impact of mentors like Paul Weber and the lessons learned that guided his transition to an in-house role at AIG, focusing on Representations and Warranties Insurance (“RWI”). He emphasizes the importance of teamwork and maintaining strong connections with his Schulte network, which played a crucial role in his career progress.

Read more as Jay discusses pivotal moments in his career, such as his shift from legal advisory to business leadership, leading to the creation of Euclid Transactional. He reflects on the skills he developed at Schulte that continue to influence his work and shares insights into current M&A insurance trends and Euclid’s expansion into Asia.

What department at Schulte did you work in, and what was your role?

I worked in the Corporate department from the summer of 2001 until April 2007, belonging to the class of 2002. Initially, I was in a three-year rotation program where I spent one and a half years in corporate finance and one and a half years in M&A before making a choice on where to specialize. I concluded my tenure with an additional two years in finance following the rotation period.

Did you have any mentors or colleagues at Schulte who left a lasting impression on you?

Yes, I had a lot of mentors and colleagues who influenced me. I remember early advice from Paul Weber, a former partner in the Finance Group, who has since passed away. Great guy. He once gave me an assignment and said, “You’ve got an hour to give me your thoughts on this document, and your thoughts have to be perfect.” It was “that’s the job, and just do it.” He told me that I just had to do my best and push forward – that I would get better.

Another time, on a deal that was around-the-clock, he said, “Just relax. You’re trying to please everyone. We’re going to get through it. It’s going to be OK.” It was advice on how to navigate the world of work and the stresses that go with it.

Share a lesson you learned as an associate and how that lesson carried over into your current career.

I learned early on that I wanted to be closer to the business. That was one of the reasons that I went into an in-house role. I was drawn to some of the decision-making aspects of being on the business side. Learning the nuances of being an in-house lawyer versus being at a law firm and how those different roles play out in terms of taking risks – taking the risks versus being a trusted adviser and giving someone comfort to take risks. Those lessons helped refine my focus and interests as I advanced my career.

I also learned how to get deals done. My early experiences at Schulte underscored the value of teamwork, collaboration and support in achieving goals – principles that have stayed with me.

How often do you keep in touch with your Schulte network?

Quite a bit. I’m still in touch with people from my class (2002) when I started and some of my early mentors. There are a lot of folks around my vintage that I stay in touch with, including a couple guys that I share a boat with. We bought a boat, and we get together on it every once in a while in the summers.

There are a lot of people at Schulte that I see socially and bounce ideas off of and use as references for my career. The most important Schulte contact that I have to date is Phil Casper, my partner at Euclid. We launched the business together. He’s been one of my best friends and trusted partners for years now. A lot of important things came out of the Schulte network for me.

Walk us through your career path once you departed Schulte to your current role at Euclid Transactional.

In 2007, I got a call about an opportunity in the legal department at AIG. It seemed interesting because it would use some of my finance and M&A background in an insurance context. The product was Representations and Warranties Insurance (“RWI”) for M&A deals. At the time, RWI wasn’t used in a lot of deals. What I liked about it was that it fundamentally made sense – the idea of shifting risk on M&A deals to free up capital through insurance. And I’ve built my career over the past 17 – 18 years around this specialized expertise and this product.

Back in 2007, did you foresee that RWI was going to become instrumental in M&A deals to the degree that it has?

Definitely not. At the time, it was rarely used. It was tens of deals a year at AIG where I was the lawyer advising the underwriters on policies, compliance and legal risks. Integrating my M&A background proved beneficial in this role. Educating the market – lawyers, bankers, clients – about the benefits of the product took time. We had to demonstrate how RWI could fit into deal timelines and reliably pay claims. We had to show them that we were M&A professionals, not just guys peddling a product that would get in the way of their deals but rather improve how deals got done.

It took 17 years to get where we are now, where it’s become standard practice in many jurisdictions, notably North America and Europe. I didn’t realize I’d be selling insurance. I just went where the opportunities were and where people were responding well to what we were doing. We just tried to do things at a high level of service like we were doing at Schulte, focusing on execution and really trying to support the team around us. We didn’t know where it would go, but we ended up selling a lot of insurance policies over the years because of that approach.

Can you describe a linchpin moment that shaped your career path?

One linchpin moment in my career was one that a lot of lawyers face in their career, and that was the decision to formally transition from the legal side to the business side. I went in-house to be a legal adviser closer to the business, but did I want to go one step further and become the business guy making the decisions on the risks and selling the product and living with the claims? I wondered, “Do I know enough about the business? Am I well-suited for the work? Will I enjoy it? Is it what I want to do?”

That was 2011. I sought advice from trusted friends and advisers, including my entrepreneur father. I asked him, “You’re a business person, what is it like? What are the challenges? Do you think I can do it?” Ultimately, I viewed the decision through a risk-reward framework. I asked myself: “What happens if I fail at it? I can always go back to being an in-house lawyer, right? I might not succeed, but does it make sense to take the chance to try something new?” And I decided, “Yes, it absolutely makes sense because I believe in this product. I do understand it.”

The product started to take off during this period, and I went from being an underwriter to being a leader of that team at AIG. I think we went from writing $50 million of insurance to $250 million. It was a period of great growth for the product, and it shaped the direction of my career. That linchpin moment at AIG, going to the business side, led me and Phil and others to start our own company in 2016.

Are there any specific skills or knowledge that you gained from working at Schulte that have been particularly valuable to your career development?

The skills that I developed at Schulte are still the top skills that we use at Euclid to distinguish ourselves in the market – our commitment to providing the highest level of service and execution. When I joined Schulte it was because people seemed nice to work with, and I think in the world of business, people want to work with people they like and are nice to be around. I had a great experience at Schulte. I enjoyed working with the people I worked with. I enjoyed the teams that I was on. That was the experience that I made sure to bring to the companies that I was building and to our clients. Making it a pleasant experience to work with us – that’s one of the things that I took away from my Schulte years.

What trends are you seeing?

We’re seeing the continued maturity of the market for M&A insurance across various jurisdictions in North America and Europe and now Asia. We’re seeing parties using insurance in large deals from $1 billion to $10 billion or more, in smaller transactions in the $10 million to $50 million range and everything in between. The elevated interest rate environment has influenced deal costs and financing, but as rates level off, we should see an increase in deal volume.

The biggest thing we’ve seen is that the claims are being paid. We paid almost $900 million worth of claims in the past eight-plus years since we launched Euclid. Our industry has paid billions of dollars in claims.

So what’s next for Euclid?

We’re particularly excited about expanding into Asia with a new team based in Singapore. This move opens up considerable opportunities to apply our proven strategies in a new market ripe for growth. Our aim is to offer the same high level of service and strategic insight that has defined our success in other regions. By being where our clients need us, we can support them globally with consistent quality and reliability.

And personally, what’s next for Jay Rittberg?

I’ve got a family here in the city, a couple of teenagers, a dog, and I really love spending time with them. Knicks season is around the corner – big trade the other day. I enjoy interacting with my brother who lives in LA and my mother and sister who live close by. I like traveling and going on vacation with my family whenever we can.

Are there any philanthropic organizations that you support?

Yes, Euclid supports several organizations, including CASA of New York State, which helps children who have been abused or neglected, and God’s Love We Deliver, a food delivery organization. We’ve been supporting Latino Justice for years, and I recently joined their board. We also support Healing Waters, a fly fishing organization that helps veterans recover from trauma. These are a few of the organizations that we support, and we look for opportunities to support others. It’s important to us to see where we can use our time and money well to improve the world. There’s always things to work on. There’s always room for improvement, right? And these great organizations are doing that.

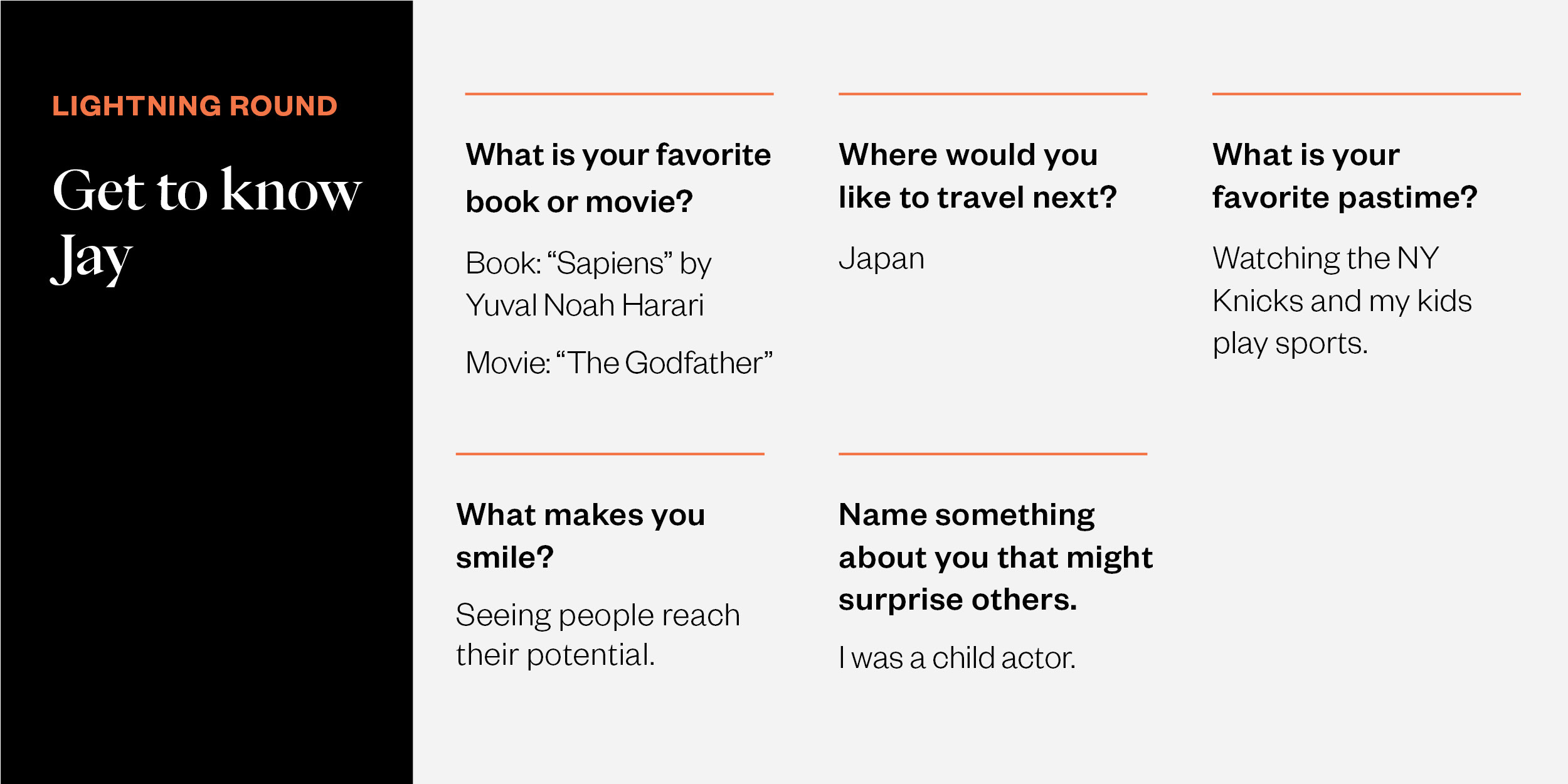

Lightning Round – Get to Know Jay