The following is a LinkedIn Article written by Justin Berutich, Managing Director and Head of Tax at Euclid Transactional.

The numbers are in and the second quarter of 2024 has shattered all expectations, setting the stage for an even more promising second half. The tax insurance industry is in high gear.

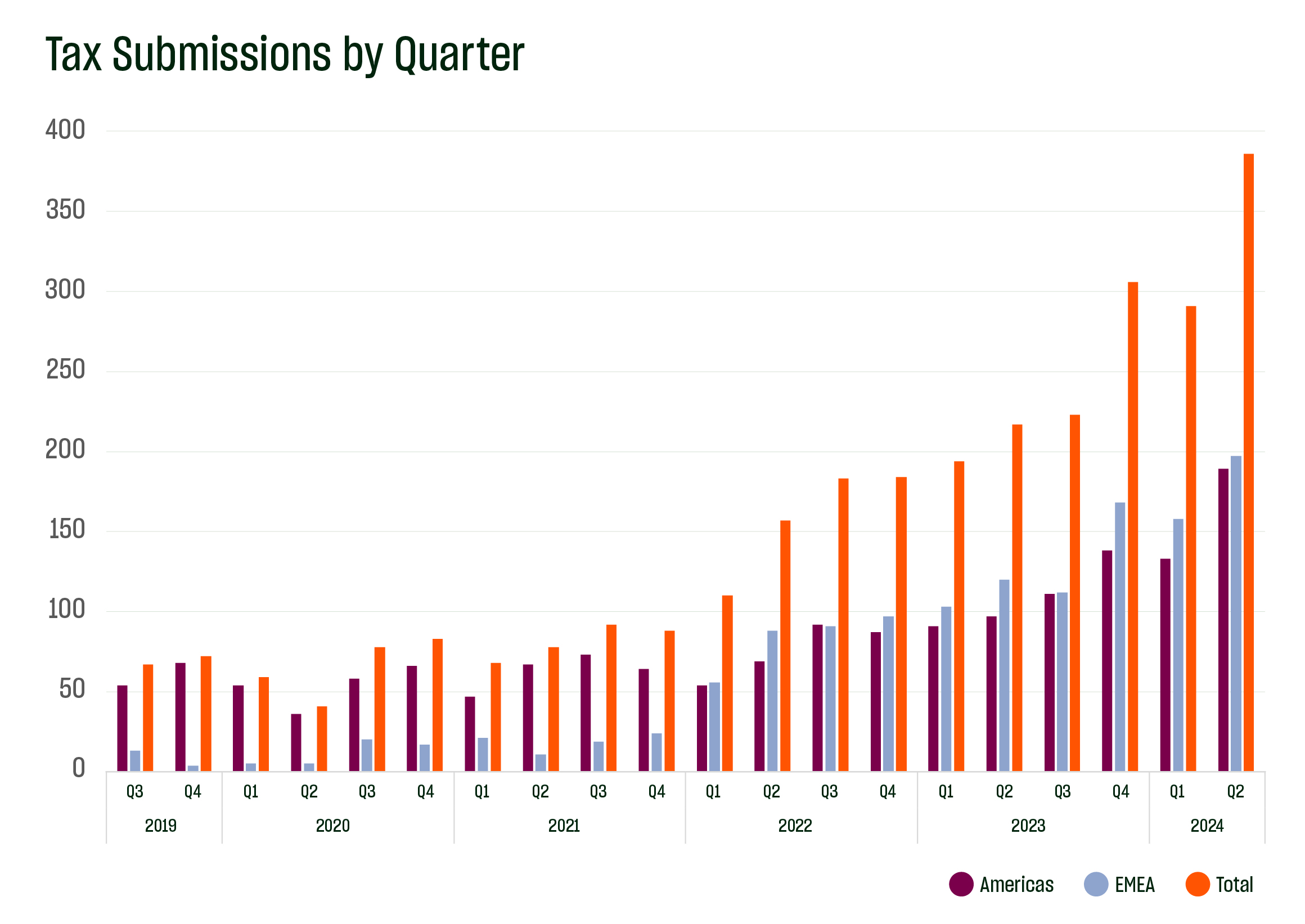

When I started in the transactional liability industry in 2016, tax insurance submissions were a rare occurrence – barely enough to keep a single underwriter busy. To fill my plate, I also worked on RWI opportunities. Fast forward to the third quarter of 2019, my first full quarter dedicated to building Euclid’s tax practice, we received 54 North American tax submissions. This past June alone, our team saw 127 global tax submissions, with 59 coming from North America.

The second quarter of 2024 was Euclid Transactional’s busiest in history with 386 global tax submissions – 197 from EMEA and 189 from North America. This represents a 33% increase over the first quarter year-over-year growth of 78% globally, 64% in EMEA, and 95% in North America.

In North America, renewable energy submissions have dominated, accounting for over 55% of the submissions received in the first half of the year. The remaining submissions are evenly split between those arising from M&A transactions and those related to strategic/balance sheet management.

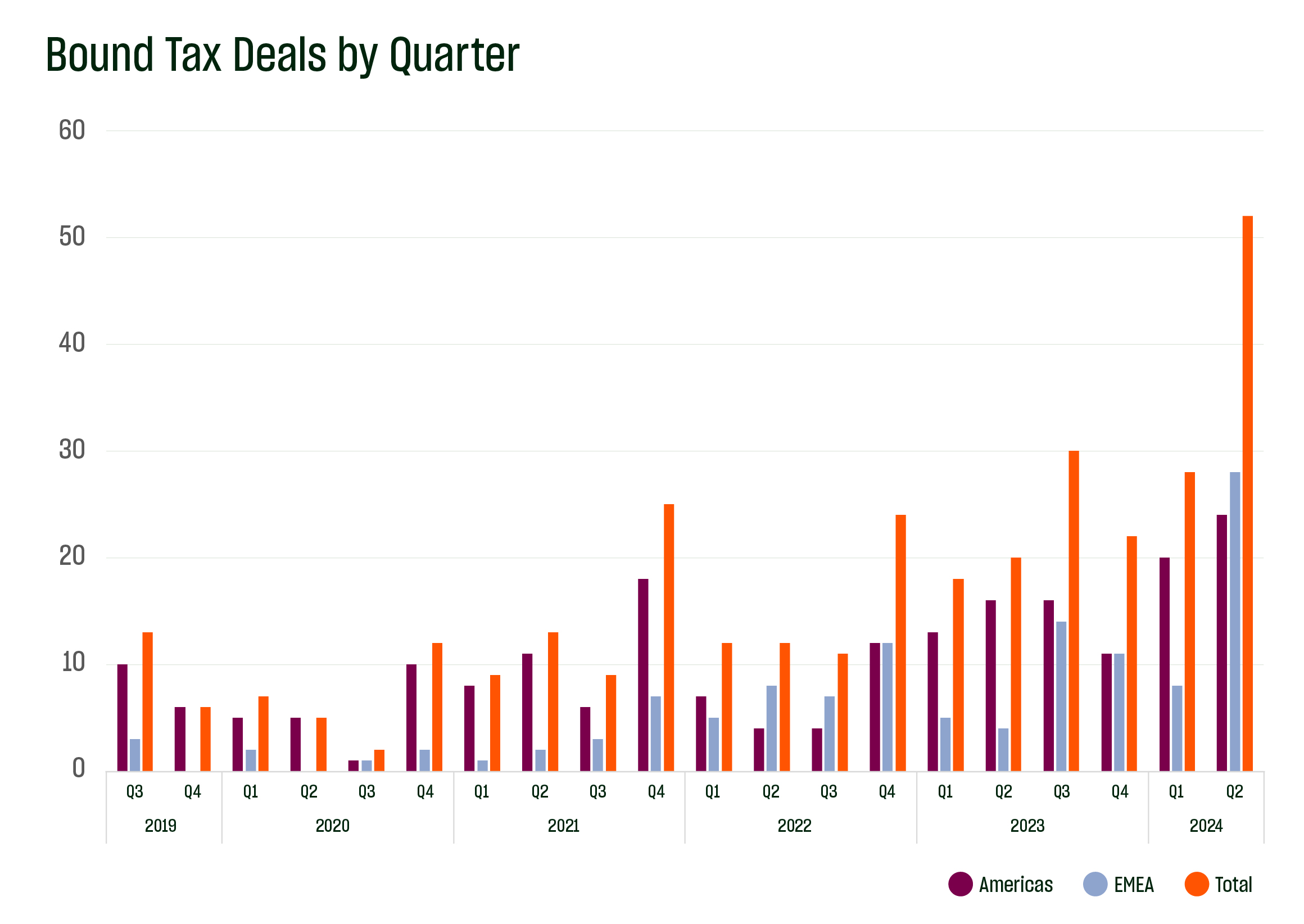

Our team’s expertise, global reach, and dedication have turned this record submission volume into record policy volumes. Our 13-person tax team has decades of combined experience with complex tax matters through insurance, corporate strategic, law firm, and accounting advisory roles.

Unsurprisingly, the second quarter of 2024 saw a record number of bound policies: 52 globally, with 28 in EMEA and 24 in North America. This beats our previous record of 30 in the third quarter of 2023 by over 70%. Last year, we bound 90 tax insurance policies, the highest in our five-year history. Year to date, our global tax team has already bound 80 policies and is on track to surpass last year’s record by the end of July.

We believe clients are choosing to work with our team because of our global reach and breadth of underwriting expertise, as well as Euclid’s industry-leading claims team. We love that our clients appreciate the value add that our 20 person claims team – which has now processed over $800MM in payments – delivers in the event that a claim does arise.

The growth trajectory of the tax insurance space is promising. Euclid Transactional’s tax team owes its success to the unwavering support of our dedicated brokers, lawyers, and client partners, all of whom have been indispensable on our path to success.

Do our numbers align with your experiences? Reach out to Euclid Transactional to discuss these or any other topics.