Managing Principal Jay Rittberg highlighted trends in the representation and warranty/warranty and indemnity insurance (RWI) market through August 2023. Read more in Jay’s recent blog (linked here) or view the full text below.

Euclid Transactional R&W/W&I Insurance September 2023 Update

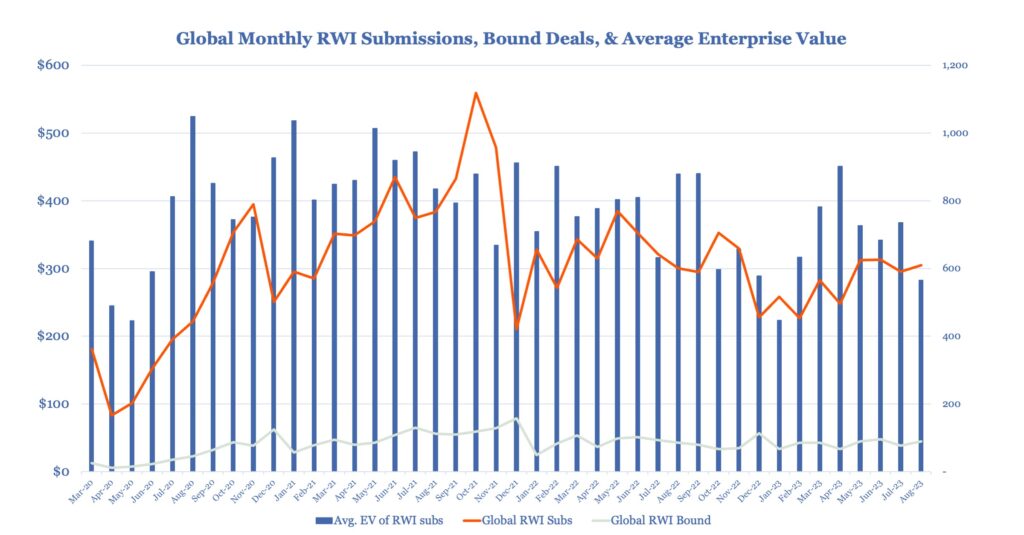

With the recent passing of legendary television host Bob Barker, it seems appropriate to ask if “The Price is Right” as we review trends in the representation and warranty/warranty and indemnity insurance (RWI) market through August 2023. In light of the information shared in Euclid Transactional’s latest claims post, which states that we received a record number of claims in July and settled claims resulting in payments of over $87 million in Q3 so far, we are carefully watching the price of policies in this environment. When the price of insurance gets too low, carriers cannot profitably pay claims and maintain responsive claims teams. For nearly every month of 2023, we saw a drop in the price of primary RWI policies in North America, and in August we saw average and aggregate RWI policy pricing drop 35% year over year to near the lowest levels in Euclid Transactional’s history. This low pricing seems related to continuing uncertainty about deal flow, particularly for larger transactions, and Euclid Transactional also saw average transaction values in August drop to the lowest levels since January 2023.

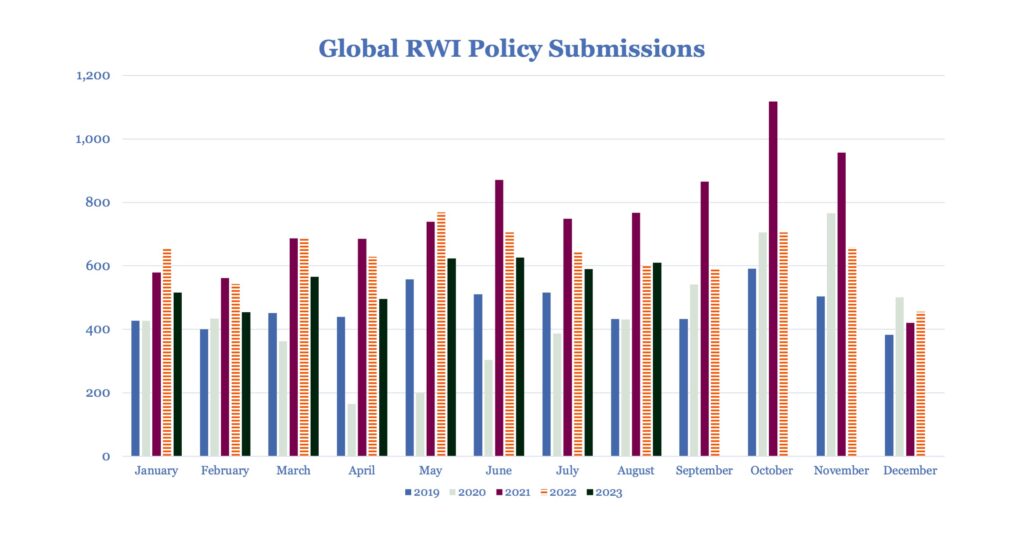

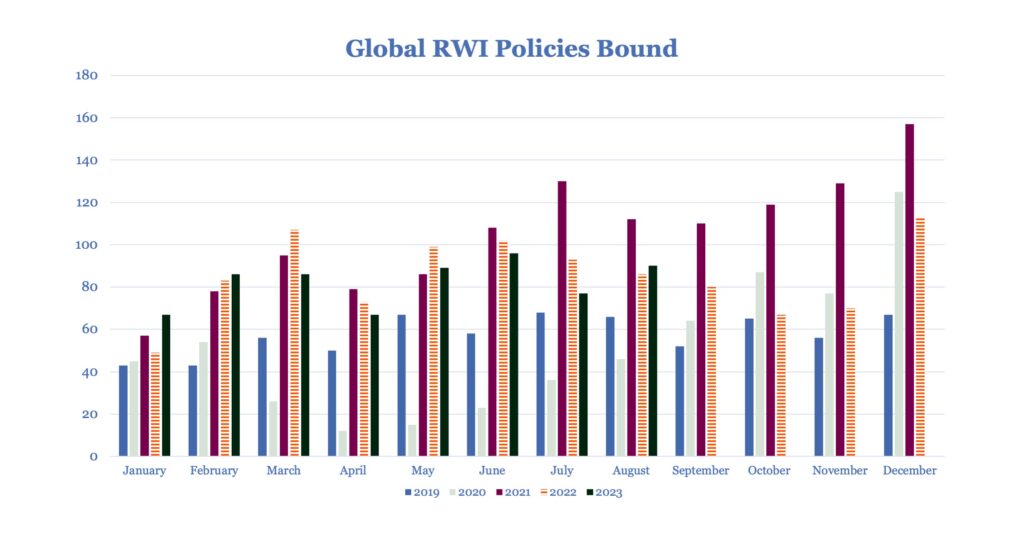

Euclid Transactional’s numbers reflect some contrasting positive trends in August. Both the monthly number of submission requests for RWI and RWI policies bound increased year over year for the first time since February 2023. Also on the positive side, we bound 90 RWI policies worldwide in August, the second most for any August and we believe our bind rate has been helped by our reputation in the market for deal execution and claims handling. However, average transaction values on the 610 RWI policy submissions we received in August were near historical lows at $282 million, down over 23% vs. July 2023.

As noted, August primary rates dropped below the rates in pre-Covid periods, and at this pricing we are concerned that the rates for our policies may not reflect Euclid Transactional’s proven track record for deal execution and fair and efficient payouts of over $600 million dollars in claims. The current rates may not adequately support the costs of the significant resources required to address the M&A market’s stated desire for efficient underwriting processes and fair and commercial claims handling.

Do our numbers align with your experiences in the M&A and R&W insurance markets? Are you concerned that The Price is Wrong!? What are your deal expectations for the remainder of 2023? Feel free reach out to Euclid Transactional to discuss these or any other topics.

Euclid Transactional Global RWI January 2019 – August 2023

Euclid Transactional Global RWI Monthly Submissions and Average Transaction Values March 2020 – August 2023