Managing Principal Jay Rittberg highlighted trends in the representation and warranty/warranty and indemnity insurance (RWI) market through September 2023. Read more in Jay’s recent blog (linked here) or view the full text below.

Euclid Transactional R&W/W&I Insurance October 2023 Update

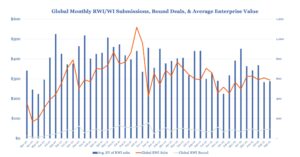

As we approach the end of 2024, we look at whether the M&A markets handed out tricks or treats through Q3. On the treat side, in September, we saw monthly representation and warranty/warranty and indemnity insurance (RWI) submission requests remain steady year over year as compared to the 8% – 21% year over year drops we saw in each of the first 7 months of 2023. Also on the positive side, Euclid Transactional bound 95 RWI policies worldwide in September, the second most for any September, and we believe our bind rate has been helped by our reputation in the market for deal execution and claims handling.

On the trick side, however, average transaction values on the 587 RWI policy submissions we received in September remained near historical lows at $287 million, down over 22% vs. July 2023, and Q3 2023 as a whole had a 22% drop in average transaction values compared to Q2 2023. Primary rates also remained near the low rates of the pre-Covid period, and at current pricing we are concerned that the rates for our policies may not reflect Euclid Transactional’s proven track record for deal execution and fair and efficient payouts of over $650 million dollars in claims.

Did the M&A market deliver you tricks or treats in Q3? Do our numbers align with your experiences in the M&A and R&W insurance markets? What are your deal expectations for the remainder of 2023? Feel free to reach out to Euclid Transactional to discuss these or any other topics.

Euclid Transactional Global RWI/WI January 2019 – September 2023

Euclid Transactional Global RWI Monthly and Quarterly Submissions, Bound and Average Transaction Values March 2020 – September 2023